The way that consumers research and make purchases is evolving, as emerging digital channels offer unparalleled convenience and access to info online. Insurance agents aren’t immune to these changes, which means that your insurance marketing strategies must adapt to new technology and the way consumers go about educating themselves on their options and how they decide to take action with choosing a solution.

Why insurance agents need to get online

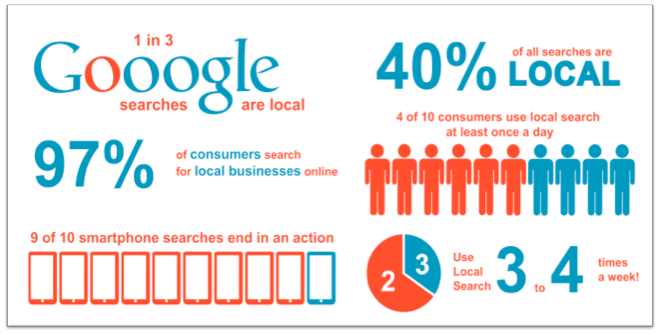

A recent survey by Marketing Profs says a quarter of Americans make at least one online purchase per week. But are they shopping for insurance? You bet.

A recent analysis from PricewaterhouseCoopers revealed that 61% of consumers aged 18-54 think it’s “attractive” to purchase life insurance online, and noted that the web plays some role in 8 out of 10 life insurance purchases.

Another study from CEB TowerGroup Insurance reported that insurance customers prefer online to any other channel (face-to-face, phone or mail) to learn about insurance products and services.

We know what you’re thinking: Those stats are probably skewed by young tech-savvy millennials who grew up in the age of Internet, and these numbers don’t apply to seniors served by insurance agents selling Final Expense life insurance or Medicare Supplements. Seniors aren’t hip to modern technology, right?

Wrong!

The Pew Research Center found that, for the first time, more than half of older adults (65+) use the internet. More seniors than ever go online (59%) and have cell phones (77%). The study showed that “younger” seniors are more likely than elderly seniors to adopt new technologies: 68% of seniors aged 70-75, and 74% of seniors in the 65-69 age group, are online.

Among older adults who use the internet, according to the same study:

- 71% go online every day (another 11% log on 3-5 times a week)

- 46% use social networking sites

- 94% agree that the internet makes it much easier to find information than it was in the old days

But you’re probably thinking: Are these seniors actually looking for insurance online, or are they just there to FaceTime with the grandkids? The latest Insurance Barometer Study by Life Happens and LIMRA says although younger consumers are more likely to purchase insurance online (possibly leaving agents out of the equation altogether), seniors aged 65+ are the demographic most likely to research their options online (51%) but then still buy a policy from an agent. For insurance agents serving seniors, this is great news!

At least, it could be great news, but only if you embrace the internet as an opportunity to:

- capture the attention of prospects

- increase brand awareness to keep your services top-of-mind

- distinguish yourself from the competition

- elevate your credibility with a professional online image

- amplify traditional Medicare/life insurance marketing efforts, giving prospects a place to go for more info after they receive a mailer, a phone call, or a visit from you

- generate free leads online

- educate consumers about the solutions you offer (and the implications of choosing the wrong plan, or no plan at all)

- gain trust—which is the critical ingredient in any sales process (online or off)—ultimately leading to more prospects, more clients, more referrals, and more profit!

To reap benefits like these, insurance agents have to get serious about building an online brand that stands out, and learn how to market life insurance and Medicare Supplements effectively.

How to get found online

In this digital age, consumers have an enormous amount of information at their fingertips to consider before making a purchase. When they go online looking for answers about Final Expense, Medicare Supplements, or other insurance options, will they find you?

Over the next several months, we’ll be rolling out an Online Branding blog series to share health/life insurance marketing tips, tools and strategies to help agents improve their visibility and get found online. If, at any point, you start to get impatient and can’t wait for the next post, skip ahead to the last few chapters of our sales training book, where we go into more detail about some of the topics we’ll be covering.

Here’s a preview of some of these keys to building an online brand that, when combined, can make your agency easier to find when prospects are searching for the solutions you offer.

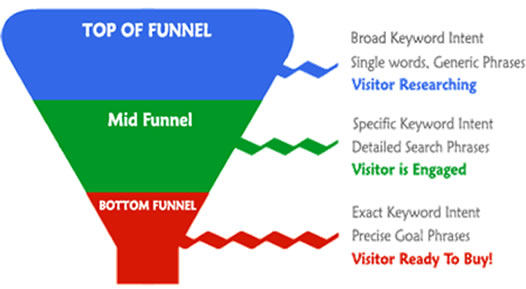

1. Targeting the Right Keywords

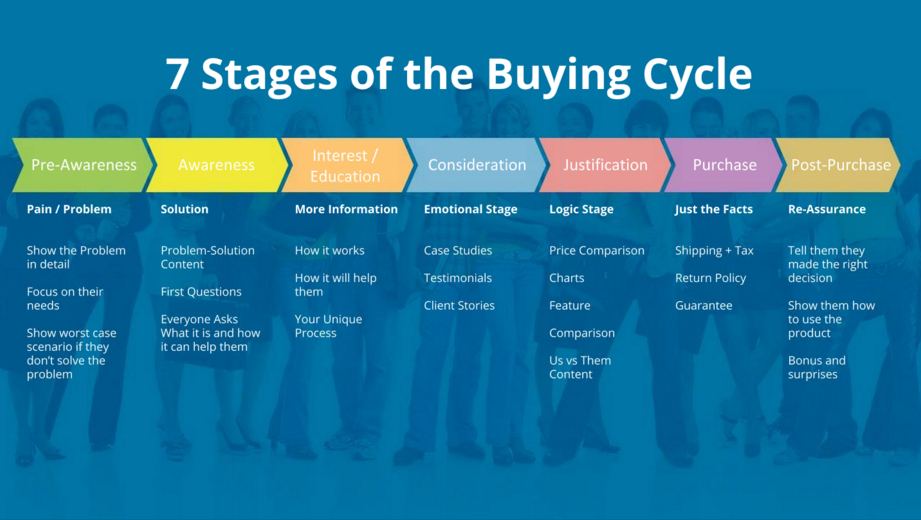

It should go without saying, but the first step to getting found online is to know what consumers are trying to find. Understand the search terms that people are using when they look up information about the types of insurance you offer, and develop valuable content around those phrases. By targeting these key words with your insurance marketing strategy online, you can increase your rank in the search results and capture prospects who may be ready to look at plan options.

2. Making a Killer Website

Once you know which key words to target, you can optimize your website to rank for those terms to attract search traffic. It’s not just about getting traffic, but keeping it and bringing it back again and again—which means your site must also be well-designed, interactive, easy to navigate, mobile friendly, and full of fresh content that visitors want to keep reading. Your website is the first (and sometimes, though hopefully not, the only) impression you’ll make on prospects, so it should speak volumes about how professional, knowledgeable, and helpful you are.

3. Securing Your Brand

The World Wide Web is a noisy place, and securing your brand is like staking claims on your digital territory. Your website domain is a big part of this, as well as setting up your business page and location through Google. Securing your brand name and vanity URLs on other social networking sites like Facebook, Twitter, LinkedIn, YouTube, Pinterest, Instagram, etc., keeps competitors and other users from taking over your space. Not only do these profiles build backlinks to help your brand show up in search results, but they connect you to platforms where you can build and interact with communities of consumers across the web.

4. Creating Content that Converts

To create content that gets found, read, and even converts, agents have to answer consumers’ burning questions about insurance—without sounding like every other agency. By making your content relevant to the unique needs of your clients, you make it more appealing to people and search engines alike. Not only are you educating prospects while building your brand expertise, authority, and trust, but when you target the right keywords, you also reap the SEO benefits—making your content even easier to find, reaching even more prospects.

Remember that different people learn in different ways, so shake up your content mix to provide a variety of formats from written blogs and white papers, to visual media like infographics and videos. But don’t keep all that great content to yourself—develop a strategy for guest posting on other blogs, which can be a boon to link building.

5. Building Links to Build Authority

Search engines crawl links to, from, and within your site to determine what your content is about and when to feature it in search results—which means links are the fuel that gets your content in front of online traffic. But don’t think you can game the system by buying links to boost your rank; Google likes to see brands cultivating legitimate links because their content is valuable enough for other reputable sites to share. Besides, as with most online branding strategies (and good wines): the best results come with time.

6. Citations and Directories

Business citations are any mentions of you or your company’s name, address and phone number online—even better if they include a link. These may include social media networks and review sites like Yelp, local directories and other listing opportunities, and even a mention in a blog comment. Any of these mentions may show up when someone Googles your name online, so citations are a big part of controlling your online brand reputation for the best life insurance marketing impact.

7. Public Relations

Media mentions can be a powerful way to exhibit your knowledge about insurance, establish credibility, and get your name out in front of your target audience (not to mention build backlinks). As the term implies, PR requires building relationships with editors, journalists, bloggers and other key influencers in your industry and local area. By engaging with them online and reaching out to them with industry news, trends, and other story ideas, you can establish yourself as an expert source who they’ll think of, and call, when they cover insurance topics.

Check back on our blog as we go into more detail about these 7 strategies to boost your insurance marketing results online. Which of these methods have been most effective to building your agency’s online brand? Which ones do you have more questions about? Let us know in the comment section below.

0 Comments