Leads are the life-blood of this industry, without them an agent is inconsistent with his success at best. Since insurance leads are a tremendous part of an agent’s marketing budget, more so than quoting tools, CRM’s or dialers, we decided to review the top direct mail marketing companies, so insurance agents can be more successful with their prospecting efforts.

Now you must be wondering why a telemarketing lead company would want to review his competition. We realize both that telemarketing leads aren’t for everyone – and that if an agent is going to be successful they’ll want to diversify their lead sources in order to not saturate the area they prospect in; especially if they have multiple agents that work a particular area.

In this addition to the Agents’ Review Corner blog series, we will be covering:

- The 7 criteria we used to rank each direct mail marketing house

- The 8 variables that can affect your mailing

- The pro’s and con’s of each vendor

- Who we recommend to try first

With this article we decided to split up the finalists into 3 tiers which we will get into more later. Now let’s take a look at how we stacked these guys up.

How We Compared These Direct Mail Lead Vendors

When we sat down to write this we thought to ourselves – what do you agents care or are most concerned about when they do business with a lead vendor. Basically, we found ourselves looking at our own business and figured out, agents want three main things:

- Convenience

- Competitive Pricing

- Customer Service

Since we have previously been in your shoes and had to order direct mail leads, we felt the largest criteria to judge whether or not to do business with a direct mail lead vendor is with the following questions:

What types of marketing mailers do they have?

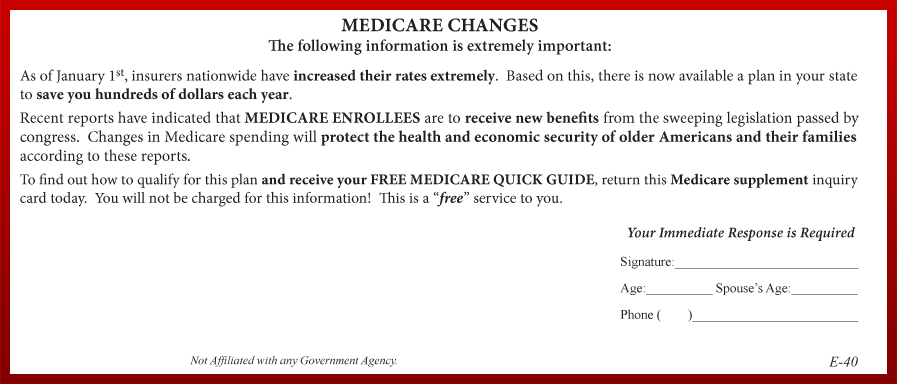

Listed below are some samples, like final expense mailer templates, of what to expect when searching for the various insurance direct mail pieces for the following insurance products:

Medicare

Turning 65 (T65)

Long Term Care

Final Expense

Mortgage Protection

Annuities

Maybe when we update this article we will also include some samples and companies that cater to the P&C agent but for now, these are the types of insurance we are noting down for these companies.

Do they provide the hardcopies mailed in by the prospect?

There’s something that could be said for the psychological aspect of sales, some agents just need the actual card the prospect mailed in, to have confidence in gaining entry to their home. If you’re an agent that prefers to door knock his or her leads instead of calling to set an appointment, you might be more inclined to want a hardcopy.

We found some vendors mailed the physical copy back weekly, like Thursday or Friday, while all of them simultaneously in real-time email you a scanned copy of the returned lead when it hits their mail house. Agents wanting to utilize the lead copy to jog prospects memory might want to print out the canned card and glue it to some thicker cardstock if they don’t want to wait to get the actual card back.

Agents should be cautious about requesting this option because some vendors charge extra for this option. It usually runs $10-$20 extra dollars, whereas one vendor actually charged a hefty fee per lead card sent back to the agent – which goes to show you should be doing your due diligence with keeping track of all the additional upcharges that get added on to a direct mail lead order.

Do they provide proof of mailing?

How do you know if a lead vendor is dropping exactly what you ordered? Unlike the telemarketing side of insurance lead generation, direct mail vendors technically could short cut corners on your mail drop to save some money, whereas it’s on telemarketing firms to make enough calls (drop enough mail) to create the number of leads that an agent ordered.

Now it would be tremendously foolish to short mailings because a business is only profitable (long term) when their clients are profiting – so we don’t feel that there’s a lot (or any) fraudulent shorting going on – at least with the more established companies. But just in case you’re a little apprehensive to doing some direct mail with a vendor, we asked them if they can provide a 3602 form that they get from the post office that shows their mail being sent out.

But be aware, some vendors will charge you more for that extra administrative task, while others may not offer this option at all. Does this mean they are shorting your order? Not necessarily, it may mean that the vendor prefers to only deal with larger agencies and IMOs/FMOs that can mail consistently and witness the returns for themselves instead of increasing their direct mail marketing and administrative costs.

Also, since 3602 forms are mostly digital these days, producing an altered one wouldn’t be entirely too hard. And even if they produced one, a larger mail house will probably be submitting thousands more in your area, so the chances of actually seeing your mail order itemized on the form would be nil.

Do they have any territory mailing restriction policy?

Nothing can be more infuriating than finding a mail house that you’re ready to use, come to find out that you can’t use them because their policy is anti-competitive. Almost every mail house we surveyed had some form of restriction when it comes to mailing out (but not every). This is done for a couple of reasons, the first is it prevents saturation of a given area for a specific mail house’s mail piece, but it also entices agents and agencies to consistently mail or lose that territory.

Now not every mailing house is the same with regards to setting up territories. Most vendors will block out from mailing the same area with the same mail card within 60 days of the last order. Some have this policy with only certain types of insurance, like Medicare or Final Expense. One way to get around this policy is to either choose a different mailer, that might have a different response rate, or to choose a different mail house altogether.

Do they offer a first class postage option?

This criterion is a little tricky when taking into consideration whether you should do business with a mail house. This is because most agents don’t need their mail going out first class, unless you’re an agent focusing on Mortgage Protection where being first in a line of agents contacting the prospect is paramount. With regards to return postage, most mail houses have standard or third class return, but can have first class returns which, of course, they will charge you a premium for.

Majority of agents should be fine with standard rates going out, because if they’re mailing consistently (which we will talk more about), then their only delay from getting their leads will be with the first order. Having leads come back first class can knock 1-3 days off with what it takes for Standard to come back. Considering the longevity, a direct mail lead has compared to other types of leads, we feel standard return is probably the best way to go.

If you’re looking to fill out your lead flow until you start getting leads in, try either getting the list from the mail house you mailed to (that will cost you extra) – and start door knocking them after 2 weeks mailing out and say after introducing yourself, “We recently mailed you a card, you might not have gotten it yet but I was in the area and wanted to know if I could come in and talk.” Or you could order some telemarketing leads from a reputable vendor for a fraction of the price of direct mail leads…

Do they have a “Cost Per Lead” program for agents?

Especially helpful for newer agents and part time agents, is utilizing what’s called a CPL program that allows the agent to effectively budget their lead flow. We get it, who wouldn’t want to just pay a flat price per lead without having to deal with all the ups and downs of mailing by the 1,000? Just be careful because not all CPL programs are created equal.

The main difference to watch out for between mail houses is the filters they use, which we will talk more in a little bit. Some mail houses have what’s called wide filters that fill out their returns by manipulating the two most widely used filters, income and age. Some mail houses to stay profitable, are able to give you a lower flat price by mailing out to younger (50-55) and older individuals (75-85) in addition to using lower (0-15k) and higher incomes (50k-75k) when it comes to Final Expense. When it comes to CPL Medicare programs, ages can go up to 85 and incomes can be waived entirely. This can give inconsistent results for some agents as they may find themselves meeting with people who don’t need or can afford a policy – best to check with the vendor and see what they charge for using different filters.

These are some of the things agents need to consider before enrolling in a CPL program – in addition to some of the vendors listed below that show they have a program in place, but it may not be for all types of insurance leads, or for your mailing area (if returns are traditionally lower there). We didn’t list the price of the vendors CPL program because they either fluctuated based on filter options, or they prices were different based on what IMO/FMO you affiliate with.

What does a 1,000 piece mailer cost for them?

Perhaps the most important piece of information agents want to know is how much the direct mail marketing cost them. The direct mail insurance lead niche traditionally measures price either per mailer expressed in cents (hopefully less than a dollar) or as a flat price per 1,000 (hopefully below $500). Prices below represent their base price range.

Just like the above CPL program, we also noticed prices fluctuated depending on what IMO/FMO you are contracted with or with what filters or lead types you selected. Manipulating filters ranged from free to adding $10-$15 to the order. Some marketing mailers also cost extra, due to the inconsistent size and mailing frequency, like T65 or Mortgage Protection – so be sure to double-check the price with your vendor.

We felt these questions were the most vital to know, initially, when dealing with a direct mail lead provider; however, if you figure out any other questions that would be helpful to ask, feel free to mention them in the comments section down below.

Warning – 8 Variables That Could Affect Your Mailings!

Being a lead provider, we’re altogether familiar with the variability of prospecting in any given area for agents – but even more so for direct mail since there’s more options to choose from as opposed to the few that one has to deal with telemarketing. Here’s 8 variables that could greatly affect your mailings besides adjusting for the area and age of the prospect as covered above:

1. The type of mailer you use

In the direct mail insurance world, for the most part, there are 3 types of direct mail to choose from:

a. Cards in Envelopes: perhaps the most commonly used, the mailer has a detachable bottom that prospects can fill out and send back in with the prepaid postage envelope supplied.

b. Trifolds: these are also known as “snap-pack” mailers, which are trifolded and detachable that a prospect can send in after filling out. Some agents don’t like the fact that the cards sent back display the prospect’s information publicly like a postcard, which could hurt return rates.

c. Postcards: the cheapest of all three, but also the most easily dismissed when sorting through the mail – unless your message resonates strongly with the prospect. Since there’s nothing to send back the call-to-action is usually to call the agent back or go online to request a more formal quote.

There are more types of mailers like surveys, where the prospect fills it out and mails it back in, but for the most part, these three types of mailers are the most common types used. We recommend going with a card in the envelope, first option, if possible. Usually that’s the type of direct mail that gets returned to the agent to take with them in person when door knocking and presenting face to face.

2. The color of the mailer

If you’re doing a postcard – it’s imperative to use color (unless again your message is strikingly on point). You only have a split second to grab someone’s attention before the postcard is sorted into the trash. A letter on the other hand doesn’t have to be so colorful because it’s being opened and looked at – usually longer than a postcard. Of course, utilizing this option is usually another upcharge.

If you’re doing a card in an envelope mailer, a color might jog the memory of the prospect you’re door knocking – even if they’re a pipeline lead that you end up knocking months later on down the road. Usually tri-fold marketing mailers are made to look “official” so seeing them in bright yellow, green or any color for that matter is highly unusual. As we will see in the next variable, looking vague and “official” can be a way of getting more lead responses.

3. The wording on the mailer

Perhaps one of the most debated, rightly so, variable on our list. Wording can not only make or break a mailing from the response stand point, but also from the psychological viewpoint of the agent trying to overcome typical human objections to being sold a new insurance plan.

Let’s discuss how wording can affect your mailing response, and we kinda hinted at it in the above 2nd variable. An agent has two choices when it comes to choosing a mailer – they can either choose one that directly talks about the solution i.e. Medicare Supplement plans or life insurance for burial, or they can choose one that talks about vague benefits that they might miss out on if they don’t get their free information.

Human nature hates more to lose out on something they’re owed or entitled to, more than getting a good deal on a rate for life insurance. Which is why you will see a greater response to vague informative mailers – but beware, you might have more objections to overcome and more qualifying to do.

Agents wanting to streamline the “quality” of their prospects might want to be more specific as to the nature of the mailer whether it’s saving money on their Medicare Supplement plan or buying life insurance to protect their families from financial stress. Sure, they will get less responses than the vague mailer, but their quality of their prospects can usually (not always) be more qualified.

Now let’s talk about the psychological effect the wording has on the agent’s performance. Newer agents might want to work with a mailer that directly mentions life insurance, because most often newer agents aren’t that proficient in repelling a prospect’s objections – especially one’s like, “I don’t need life insurance,” or “I already have life insurance.” Agent’s armed with the actual physical reply card can simply point at the card and with confidence, demand some time to go over the information they asked for.

Agent’s wanting to maximize their lead flow will want to use vague wording so that they can attract the most responses, and since more experienced agents have their process down and are experienced in addressing a prospect’s concerns or objections – they can easily pivot to the solution after taking them down through a polished presentation that address the need the vague wording on the mailer hinted at. Sure, they wanted an update to the changes happening to Medicare but helping them save $50 a month on their Medicare Supplement isn’t bad either. Nor is educating people on the miserable $255 death benefit provided by Social Security – and helping them to supplement it with something that’s affordable that will help them address that financial obligation.

I guess it just comes down to two things, experience and efficiency. Do you feel you need the card to safe life insurance to sell them a plan, or can you tactfully pivot? Are you looking for more leads due to a tight budget, or are you looking to maximize your time with more possibly qualified prospects? Only by trying both types can you find out what works best for you.

4. The form prospects fill out

Even the form the prospect has to fill out can determine how many leads you get back. As it is online, so it is offline – the number of forms to fill out inversely affects the return you get. If you require more information from a prospect there are those that will balk at filling out the mailer and sending it back. We recommend choosing a mailer that only asks the information you need – some have spots to put the age, spouse name, spouse’s age, whether they smoke, and a phone number in addition to spots for their name.

Having a phone number is definitely helpful, but asking for ages, smoking status or plan names is asking your mailer to qualify for you. And again, you may want that in your mailings, but the majority of agents would rather just get in the door to see how they can help the prospect – especially if they cross-sell other types of insurance. If you really want to know their ages, just get the list that comes with the mailing.

5. The number of call-to-actions you have on the mailer

This isn’t debated as much, but we still see this question asked once in a while – and that’s whether to add a phone number for the prospect to call on the mailer. Some agents feel it attracts a certain type of buyer that would only call and not send the mailer in, whereas most agents feel taking the time to fill out the card and send it back is in itself an act that qualifies a prospect’s interest – not to mention it puts the agent in the driver’s seat by allowing the agent to control the act of contact so that it sets them up for maximum success to overcome objections and get into the house.

I think having a phone number would be better for post cards where you’re trying to get the prospect to take immediate action, but for mailers, let the prospect fill out the info and send the card back in – don’t make the prospect choose which action to take, make that choice for them.

6. How good your data is

An agent’s mailing is only as good as the quality of his data and the filters he selects to narrow down his market. The amount of mail that goes undelivered due to poor quality lists not being updated or refreshed weekly ranges from 5%-20% depending on the market you’re targeting. So making sure you’re working with a mail house that draws their lists fresh is paramount to gettingthe most of your mailings.

A more obvious way of affecting your response numbers is by manipulating the filters you use to target for your mailing. Here are the traditional filters for the following types of insurance:

- Mortgage Protection is houses above $100,000 and within 3 months of purchase – the sooner the better though. A typical response rate for Mortgage Protection direct mail leads is around .75% – 1%.

- Medicare Supplements is ages 65-80 and income $25k-$100k. Some agents recommend changing the filters to ages 67-75 in order to weed out new enrollees that either feel they know it all when it comes to Medicare or haven’t gotten their first rate increase – we’re reminded by the late Frank Stasny. There’s an additional metric for Medicare you want to mindful of and that’s the MAPR or Medicare Advantage Penetration Rate. If you’re selling only Medicare Supplements focus on areas that have an MAPR less than 20%-25% or else, you could get a lot of Medicare Advantage responders. A typical response rate for Medicare Supplement direct mail leads is around 1.5% – 3%.

- Medicare Advantage filters are usually 65 and up – since there’s no health to qualify for, and since many plans are low to zero month premiums, there’s no use in specifying an income. A typical response rate for Medicare Advantage direct mail leads is the same as Medicare Supplements which is around 1.5% – 3%.

- Turning 65 filters are easy, anyone about to turn 65 years old in the next 6 months or sooner. Agents usually find the sweet spot to be 3-5 months out before turning 65. If you sell Medicare Supplements, only you’ll have to be mindful of the income and MAPR filters. If you sell both Medicare Supplement and Medicare Advantage, it doesn’t matter the MAPR rate or income technically. A typical response rate for Turning 65 (T65) Medicare direct mail leads is around 1.5% – 3%.

- Long Term Care filters are either ages 45-60 or 50-69 with an income of $75,000 and up. A typical response rate for Long Term Care direct mail leads is around .5%.

- Direct mail Final Expense leads filters are traditionally ages 50-80 with income 15k-60k, however we do see a lot of agent tighten up their ages to 55 or 65-75 years old (especially if they’re trying to cross-sell Medicare). A typical response rate for Medicare direct mail leads is around 1%.

One thing to note about filters is that they aren’t entirely reliable – least of all the income filter. The number that’s put down for someone’s income is collected from all sorts of data appending centers, that probably aren’t too up to date on the privy details of people’s inner finances. We recommend that if you’re trying to target a certain income you look individually at the area’s real estate prices. Chances are you’re not going to sell a lot of final expense in a well to do neighborhood, and likewise you aren’t going to sell many Medicare Supplements in the urban metropolis centers where $0 MA plans abound due to tight populous medical networks.

7. How consistent you mail out

A very important variable that determines your campaign’s response rate is how often you send out a particular mail piece. Where we talked about the use of territories by direct mail houses to keep area response up from being over-saturated, we also see agents (even in our telemarketing lead business) not order consistently to keep themselves busy and to also ascertain the true response rate for a given area.

You never know if another agent recently mailed there, how consumers interact around holidays, or whether you just got a bad week – if you don’t mail consistently. Ask any agent that’s successful and they’ll tell you that you need two things to consistently succeed in this business; consistent lead flow, and consistent following-up with those leads (hopefully at least 6-8 times).

8. What kind of contracts you have

The last variable that we will touch upon lightly, because it’s very complex and best reserved for its own post, is the contracts an agent has. If the agent is earning a fraction of the commission they could be earning, that will mean less money coming back to them to not only replenish the marketing coffers, but to allow the agent (and possibly their family) to live day to day on that income.

There are three reasons why an agent takes a lower contract:

- They are provided comprehensive hands-on training like being paired up with a mentor that can show them in person how to prospect and sell insurance

- They are given free leads or access to mailings at a discount rate

- They are new, and/or they just don’t know any better

Agents not only need fair contracts to help them navigate this challenging landscape in insurance sales, but they also need access to leads at an affordable price that doesn’t gouge the agent while enriching the FMO/IMO. Be sure to double check your (proposed) contracts before signing up for an enticing lead program offered by an FMO/IMO – and remember, nothing in this world is for free.

Let’s Meet the Contestants

Listed below in alphabetical order are the top used direct mail houses for insurance agents. We included a brief annotation of what we saw when it came to agents talking about or reviewing their brand. Take what you here for a grain of salt understanding the 8 variables above that could affect any given agent’s mail campaign.

1. ARM

ARM is a direct mail lead company that handles a lot of the senior niche types of insurance like Final Expense, Medicare, and Annuities, but also does Mortgage Protection too. They were extremely nice on the phone, and although their site isn’t much to look at – they seemed willing accommodate almost all the comparison criteria at a fairly decent price. As far as reviews go we haven’t seen much on them but we did notice that they have a ton of lead cards to choose from.

2. Jen Marco

Jen Marco specializes in the trifold mailers and has one of the best ordering systems we reviewed. Simply login, run the counts, specify the mailer and you’ll soon have your campaign sent out within a matter of days. They have a huge selection of mailers to choose from, and they only have territories for Medicare mailers – and not for direct mail Final Expense leads. We also note, that although they don’t always answer the phone, we did get a prompt email back from them. We also have found quite a few positive reviews for the company – and by far the lowest prices of any of the mail houses.

3. Kramer

Wrong Kramer, the Kramer Direct we are talking about has been generating direct mail insurance leads for over 30 years. You have to be doing something right to be around that long. They are a big company that primarily deal with larger agencies it seems. Their price is a little high, but the salesperson on the phone told us “they are usually running a deal” so we put the “deal” price in parenthesis in the table below. Despite the company being a powerhouse in the financial industry, agents on the popular forum website, www.insurance-forums.net, don’t seem to be happy about the returns they get compared to what they were expecting (check above variables).

4. Lead Concepts

Lead Concepts hasn’t been in business as long as Kramer Direct, but they’ve been around since the early 90’s. They have a ton of different insurance lead types to choose from – and also a ton of non-insurance industries they also serve. Their prices are moderate to high, but other than the higher pricing, haven’t heard anything bad about them. We do like the video they have showing their mailhouse – if only all lead providers were that transparent!

5. Lead Connections

Lead Connections is perhaps one of the more popular Final Expense direct mail houses that make it easy for a new guy to do business from their CPL program to the variety of mailers to choose from. The owner Chris Ethridge, seems like an outstanding guy and always returned our emails promptly. The only complaint we see them, is that they have territories, but that’s like that with most direct mail houses.

Here is a video Chris did with the ILIAA, talking about how direct mail works and how he caters exclusively to insurance agents.

6. Leads2Success

Leads2Success is another mail house that, like Jen Marco, has an easy to order back-office where you can login, run counts, view scanned leads etc. Their prices are like everyone else’s, but one thing that we did notice that’s different about them that we didn’t find with any other lead house was that they have an agency, The Assurance Group (TAG), that they also affiliate with. Something like that will always make agents wonder if their leads are being cherry-picked. We did notice agents although were near unanimous about their good customer service, they were equally agreeing on the seemingly lower returns they got back.

7. LRG

LRG is a company we covered before on our review of data vendors, they also generate direct mail leads for insurance agents. Hard to get them on the phone, but like Jen Marco always follow up with email in a timely manner. Their website is pretty rudimentary and not as advanced as some vendors reviewed here. Unfortunately we didn’t find as many agents talking about their direct mail leads as much as their data service.

8. Main Street Power Mail (MSPM)

MSPM is another mail house that’s been around for at least 15 years, not quite as old as Lead Concepts or Kramer Direct. They have quite few leads to choose from that the salesperson will email you – and their pricing isn’t anything to write home to mom about. We saw both positive and negative reviews about them – what lead provider doesn’t have a spotless record? Where we saw agents used them in the past, we see few reviews as of recent. Maybe mediocre returns combined with mediocre prices makes for mediocre buzz.

9. Need-A-Lead

Need-a-Lead is built for the agent catering to the senior market. They have great prices, tons of lead samples, and their customer services is great. One large notable is they don’t have territories, everything’s on a first come first served basis. Their CPL program is only for Final Expense life insurance, and they have some good reviews we’ve noticed.

10. RGI

RGI is a direct mail house suited for larger agencies and IMOs. They require a signed NDA before sharing anything with you (like pricing or samples). They also require, for their CPL program, 50% of the first two months’ lead budget upfront. They also told us that we would need a dedicated “lead manager” to manage the account – by far the most unrealistic company for individual agents to use.

11. Target Leads

Another big player who’s been in the industry for over 30 years is Target Leads. They seem to deal exclusively within the insurance industry, like Lead Connections. They are middle of the road on pricing, but their site is super helpful and accessible with regards to running counts which is a distinction befitting a top-notch direct mail vendor. Aside from the fact that they’re used quite a bit by IMO’s, you can see a little more about them below in their explainer video.

Company

- Final Expense

- Medicare

- Turning 65 (T65)

- Annuity/Social Security

- Mortgage Protection

- Ltci

- Mail Hardcopy

- Proof of Mailing (3602)

- Territories

- 1st Class Option

- Cost Per Lead Program

- PHONE

- WEBSITE

Lead Connections

- Y

- Y

- Y

- Y

- N

- Y

- Y

- Y

- Y

- N

- Y

- 972-814-3484

Need-a-Lead

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- N

- Y

- Y

- 800-253-1432

Jen Marco

- Y

- Y

- Y

- Y

- Y

- N

- N

- ?

- Y

- Y

- N

- 888-562-7011

Kramer Direct

- Y

- Y

- Y

- Y

- N

- N

- Y

- N

- Y

- Y

- N

- 888-572-6373

Company

- Final Expense

- Medicare

- Turning 65 (T65)

- Annuity/Social Security

- Mortgage Protection

- Ltci

- Mail Hardcopy

- Proof of Mailing (3602)

- Territories

- 1st Class Option

- Cost Per Lead Program

- PHONE

- WEBSITE

Target Leads

- Y

- Y

- Y

- Y

- N

- Y

- Y

- N

- Y

- Y

- N

- 800-723-5254

Lead Concepts

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- N

- Y

- Y

- N

- 800-283-0187

ARM

- Y

- Y

- Y

- Y

- Y

- N

- Y

- Y

- Y

- Y

- N

- 800-992-2722

LRG

- Y

- Y

- Y

- N

- Y

- N

- Y

- Y

- Y

- Y

- N

- 888-650-5077

Company

- Final Expense

- Medicare

- Turning 65 (T65)

- Annuity/Social Security

- Mortgage Protection

- Ltci

- Mail Hardcopy

- Proof of Mailing (3602)

- Territories

- 1st Class Option

- Cost Per Lead Program

- PHONE

- WEBSITE

Leads2Success

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- N

- Y

- Y

- 877-888-1322

MSPM

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- N

- 866-540-6797

RGI

- Y

- Y

- Y

- Y

- N

- N

- N

- N

- Y

- Y

- $20+

- 678-269-7754

Plum

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- Y

- N

- Y

- N

- 800-992-9663

WINNERS AND LOSERS

In this article we are going to break out the direct mail marketing vendors into three tiers. We recommend trying out companies in the first two tiers – obviously the first tier is where you’ll want to start if you’re looking for a mailerlead vendor.

TIER 1

.

- Lead Connections

- Need-A-Lead

- Jen Marco

Tier 2

In this tier, we have the following companies:

- Kramer Direct

- Lead Concepts

- Target Leads

Tier 3

Companies in Tier 3 are companies that usually make it hard to create a campaign or view pricing and lead samples (bad website), whereas some on this Tier are here because of the amount of shoddy reviews we found while researching for this article. It doesn’t mean you shouldn’t work with Tier 3 companies, we just feel there are more solid companies to try first. Maybe some of the companies will take note of this article and strive to enhance their offering and provide more convenience and value.

In this tier, we have the following companies:

- MSPM

- Leads2Success

- LRG

- ARM

And again, the reviews could be due to any number of the listed variables covered above, but given that there are other companies to work with we suggest unless the other companies in the two other tiers have your territory blocked up – to try those first.

As always, if we forgot or didn’t include a direct mail lead vendor you’ve been using with success, or you’ve worked with one of the vendors above and would like to leave your review of them – please do so using the comments section below.

Really your post is too wonderful, carry on your work and sharing your information with us.

I am interested in doing something like this for the community that I live in. However there is only 450 of us so I would not have enough contacts for 1000. Do you guys do smaller orders or would you be willing to do a smaller order. I have all of the names and address from my community, I just need to get a mailer set up. Please let me know if you guys can offer anything less than 1000.