Previously in our sales training blog series, we covered what agents need to do AFTER the sale to offer good customer service so clients don’t lapse their policy. In this post, we’ll explore two other activities that agents can utilize after the sale to get the most out of their lead budgets: cross-selling additional policies to their leads and clients, and seeking referrals from them.

More specifically, in this article we will cover:

- Statistics that show how cross-selling increases persistency

- How the agents who collaborated in our book cross-sell insurance to their clients

- The two ways insurance agents can obtain referrals

- What tool the agents in our book used more than any other to increase referrals

If you read this article and put into practice some of the scripts and tips that the agents in our book have used successfully – then you can expect more clients, higher commissions, and lower over-head costs.

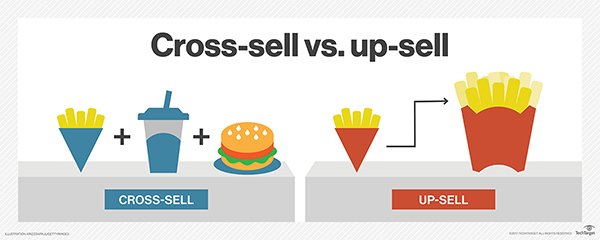

What Does It Mean to Cross-Sell?

Not to be confused with up-selling (which is the art of increasing the purchase amount or value in a sale), cross-selling is the act of selling another policy to your prospect-turned-customer. A simple way of segmenting your book of business is to use the customer-client-fan model. The customer-client-fan model can help you classify how much value you’re getting from your customer base, in terms of repeat business and additional referrals.

The rules of this model are pretty easy to understand. They build on Al Granum’s 10-3-1 system of prospecting, which states that leads are separated into two classes: suspects and prospects. While this can differ somewhat across sales mythos, suspects are simply people who could potentially want your offer. Prospects are suspects who have expressed some sort of interest. Prospects are leads, but they may not necessarily be qualified leads. Qualified leads have answered a range of questions as to whether they are suited to the solution you’re presenting them.

Going beyond the Al Granum system, if a qualified lead buys a policy, they then become a customer. If you sell the customer an additional policy that is a different type of insurance, then that customer becomes a client because they are considered a repeat buyer.

If the client ends up referring someone to you, either because of the additional type(s) of insurance you sell or because you’ve had them on the books for some time, then that client then becomes a fan. If the fan refers multiple referrals your way, then the fan could be classified as a raving fan.

Your ultimate goal as an insurance agent is not just to turn qualified prospects into customers, but to turn customers into clients, and clients into raving fans of your service.

When Should I Attempt to Cross-Sell?

Generally, there are four main times agents typically attempt to cross-sell a prospect or customer:

1. During the initial contact when creating or responding to a lead, if they aren’t interested in the first solution presented.

Example: An agent is going door to door, attempting to sell Final Expense life insurance. But if he can’t help a suspect with their life insurance, he also asks if they might be interested in saving money on their auto insurance.

2. After selling the prospect before delivering the policy.

Example: A Medicare Supplement agent cross-sells a Final Expense plan to a customer to reallocate the money he saved them by re-shopping their Medigap plan, like how our book collaborator Jacob Anderson cross-sells his clients:

“I ask them if they need a plan for burial expenses, and help them use part of the savings toward a Final Expense plan. It helps that no new money is being spent. I tell clients, ‘With the money you save on your Medicare Supplement, you can take out an additional life insurance plan so that you’ll have enough for your final expenses.’”

3. After delivering the policy to the customer.

Example: After delivering a life insurance policy, a Final Expense agent asks customers what kind of Medicare coverage they have (Medicare Supplement or Medicare Advantage) and offers to touch base with them again around October to double check their Medicare coverage during the Annual Enrollment Period if they have a Medicare Advantage. If they have Medicare Supplement, the agent attempts to cross-sell them to a plan that can save them money – maybe even enough money to pay for the Final Expense policy they just got.

4. Throughout the year and thereafter.

Example: By utilizing drip marketing, an agent can periodically call, text, email, and mail letters or postcards to insurance customers reminding them about the other types of insurance you sell. One of our collaborators, Medicare Supplement agent Robin Penrod, cross-sells customers consistently using this approach:

“I generally do a two-week follow-up call, making sure they received their card, remembered to show their doctor, etc. I will then ask about life insurance. I also do a letter four months after the sale and list what I do, and of course I call in September to get a jumpstart on a Part D prescription plan.”

Another one of the collaborators from our book, Final Expense agent Brandon Webster leverages his staff to conduct his ‘touch campaigns:’

“I have my assistant contact all clients after the policy has been received and issued. We always ask if they can give us 3-5 names of people they know who they want to make sure are protected just like them.”

Another collaborator, Matt Mungia, MBA, tries cross-selling his Final Expense clients before he leaves an appointment:

“I now offer Medicare Advantage. When I am leaving the house, I give them another business card and let them know about all the other things I offer. Sometimes that leads to further conversations and further sales.”

Tom Massey uses cold hard facts to cross-sell his Medicare Supplement clients:

“I try to cross-sell all my Medicare Supplement clients. I ask them if they’re set for life insurance. I tell them more than 40% of Americans have no life insurance and many [others] who haven’t upgraded it to keep up with inflation.”

In reality, if you’ve met a customer’s needs with one product, cross-selling another product after the sale can be even easy. It’s even easier if you’ve saved them money on an over-priced Final Expense or Medicare Supplement policy. But getting an easy sale isn’t the only reason to cross-sell. To really sustain and maximize sales, there are three vital reasons why agents should be cross-selling their clients…

Cross-Selling to Generate Referrals

The more additional policies you can cross-sell a customer, the more helpful and valuable you become to them – which can have three huge benefits on your business. Cross-selling can:

- Increase commissions from the sale of extra policies

- Decrease the chances of the client lapsing because they’ve more policies with you

- Increase the opportunities to gain referrals from repeat clients

If you’re able to cross-sell an additional policy, it’s because a customer trusted you enough to follow your recommendation to get more coverage. If they trust you, they’re less likely to lapse a policy, especially if they have more than one of them with you. If they trust you AND have multiple policies with you, then it increases the chances of receiving referrals from them.

Not only are they more likely to refer you to their friends or family because you’ve helped them out more, but because you offer more than one type of insurance, you give them more opportunities to recommend you to someone they know who might be considering that type of insurance, as compared to if you only provided a single service.

The Power of Referrals

Why we are so intent on harvesting referrals after making a sale? Some of the reasons why agents should muster up the courage to seek out referrals include:

- Unlike many types of leads, referrals are free!

- Referrals are some of the warmest leads an agent can encounter.

- Building on the previous reason, referrals also have some built-in trust for the agent.

- Referrals are more likely to in turn refer you again if you do a good job – leading to third generation referrals (a referral that knows you from another referral).

Still not convinced? In addition to the reasons above, agents will want to seek out referrals after seeing these consumer behavior statistics from Annex Cloud’s blog that illustrate the powerful sales potential that referrals have:

- The Word of Mouth Marketing Association reports that every day in the United States, there are approximately 2.4 billion brand-related conversations. People are constantly talking about the products and services they enjoy, and the companies who offer them.

- 92% of consumers trust referrals from people they know. – Nielsen

- People are 4 times more likely to buy when referred by a friend. – Nielsen

- 77% of consumers are more likely to buy a new product when learning about it from friends or family. – Nielsen

- 81% of U.S. online consumers’ purchase decisions are influenced by their friends’ social media posts, versus 78% who are influenced by the posts of the brands they follow on social media. – Market Force

- 43% of consumers are more likely to buy a new product when learning about it from friends on social media. – Nielsen

- 85% of fans of brands on Facebook recommend brands to others. – Syncapse

- 84% of consumers say they either completely or somewhat trust recommendations from family, colleagues, and friends about products – making these recommendations the highest ranked information source for trustworthiness. – Nielsen

- 74% of consumers identify word-of-mouth as a key influencer in their purchasing decision. – Ogilvy/Google/TNS

- 1 offline word-of-mouth impression drives at least 5x more sales than 1 paid, and as much as 100x more in higher-consideration categories. – WOMMA

- Word-of-mouth is the primary factor behind 20-50% of all purchasing decisions. – McKinsey

- On social media, 58% of consumers share their positive experiences with a company, and ask family, colleagues, and friends for their opinions about brands. – SDL

- Consumers rely on word-of-mouth 2x-10x more than paid media. – Boston Consulting Group

- 55% of consumers share their purchases socially on Facebook, Twitter, Pinterest, and other social sites.

- 59% of Pinterest users have purchased an item they saw on the site, vs. 33% of Facebook users who have purchased an item they saw on their news feed or a friend’s wall.

- Word-of-mouth has been shown to improve marketing effectiveness by up to 54%. – Market Share

These compelling statistics, combined with the above reasons we shared, will convince you that seeking out referrals is the best long-term game plan for getting the most out of your lead marketing budget. Now the next question is how to seek out referrals – let’s check that out below.

Ask or Earn: What’s the Best Way to Obtain Referrals?

Insurance agents will encounter two main ‘camps’ when it comes to obtaining referrals. The first camp of agents believe that referrals should never be asked for, they should just be earned, organically. This is further echoed by some of the collaborators in our book, like Final Expense agent Josh Doe, who relies on good old-fashioned customer service to get referrals:

“I just try to provide good service and the referrals come naturally. I don’t generally ask for them.”

Tom Massey explains some of the ways he provides good customer service to entice referrals:

“The best way to get referrals is to provide great service. I return calls the same day and get my clients’ problems taken care of ASAP. When they buy, I let them know that I’ll be glad to help their friends and family. I also send a thank you card after the sale.”

The logic is of this camp is that, if you’re actively and attentively doing your job as an insurance agent to take care of your clients’ needs, then referrals should come effortlessly – and to some extent, they do. But why wait for referrals to trickle in, when you can actively seize them instead? That’s why another camp of insurance agents believe in straightforwardly asking clients (and even leads who don’t buy from them) to refer their services to someone else who could use their help.

Here’s the script that Frank Bahr, one of the collaborators in our book, uses to ask his Final Expense clients for referrals,

“I hope I have been helpful to you and your family. Other than your immediate family, who are three friends you know would attend your funeral? Would it be okay to tell them about the service I was able to provide for you?”

Tamara Sasso, also a Final Expense agent, takes a couple of approaches to get referrals:

“I ask my clients if they know anyone else I can help, such as friends or family. I also get a page of contacts who would need to be called if they passed away, and call those contacts as well, with their permission.”

Lawrence Malone similarly asks for referrals by reminding Final Expense clients of the value he provided:

“Mr./Mrs. Jones, how does it feel to have finally taken care of this? Alright, well if you don’t mind, could you write down about five people who would also benefit from the peace of mind you have right now?”

Todd Graves takes notes about each prospect or client, and then systematically asks about their beneficiaries AFTER he demonstrates value by helping them with their Final Expense insurance:

“After a policy is placed, I usually have a good idea as to family members like children and grandchildren, and talk about the unexpected death of younger loved ones, saying the time to cover them is when costs are low at a younger age.”

Medicare Supplement agent Todd R. King shares some wise counsel for new agents who are learning to ask for referrals:

“One of the first mistakes I see agents making when asking for referrals is to ask a blanket statement like, ‘Do you know of anyone else who could use my help?’ You have just given them the whole world to think about, and therefore most can’t think of anyone. If you find out things that they like to do through your warm-up and presentation, then that will help you in narrowing it down. For instance, if they are a golfer or avid church-goer, you would ask something like, ‘Do you know anyone you golf with that could use my help?’ or ‘Do you know anyone in your Sunday School class that I may be able to help?’ It just helps them think about it easier. Be sure to leave extra cards, too!”

Whether you provide amazing service that clients can’t help but tell their friends about, or you directly ask clients to refer their friends to you, cultivating referrals should be the ultimate aim of any lead generation program. Not only are referred leads easier to work, they’re free!

How to Make Yourself Referable

Don’t think you can just ask for referrals and expect someone (even your best client) to just hand them over to you. That transfer requires years of unfaltering service – which you can accelerate, if you focus on making yourself more referable.

Prospects and clients alike want to know that you will take care of their closest friends and family with the utmost respect, trying your hardest to get them the “most value for their premium dollar” (as Frank Stasny would say).

So, how can you accelerate a referral process that needs years of reliable service to prove? Agents can increase their chances of being referred by clients if they can consistently illustrate their credibility, integrity, and reliability in a number of ways – even before meeting a lead for the first time.

The most referable insurance agents have:

- A search engine optimized website with helpful content that’s easy to navigate

- Positive online reviews and testimonials

- An active presence on major social media channels (like Google, Facebook, Twitter, LinkedIn)

- Engaging videos on YouTube that help them connect with consumers

- The personality of a genuine human being online, vs. seeming cold and automated

- Quick response times to answer and return phone calls in a reasonable time frame

- An active presence in local causes and charities

- Brochures to illustrate and convey their value professionally

In addition to establishing these credibility-builders to increase your referable-ness, maintain consistent and constant contact with your client base to make you even more referable in the minds of your clients. One way to do that is with the next tool we’re going to talk about, which is the most popular tool among agents for cross-selling and soliciting referrals.

Using SendOutCards to Obtain Referrals on Autopilot

Perhaps the most useful tool in the insurance agent’s arsenal, SendOutCards, a greeting card service that lets you customize, prioritize, and personalize cards online, and they take care of the rest – printing, stamping, and mailing the card for you (and sending other gifts, too). This helps agents:

- Save time communicating with clients and leads using personalized, printed cards

- Stay in contact with prospects and clients consistently (and stay top-of-mind, as a result – which can minimize lapses)

- Cross-sell other types of insurance with automated (but personalized) reminders

- Solicit referrals

The average insurance agent is probably too busy to shop for greeting cards, handwrite messages, and drop the mail at the post office. This makes it much easier. After a few minutes and a few clicks on SendOutCards, this tool makes your clients feel like you took the time and consideration to send them a nice note in the mail. This has the power to multiply an agent’s income and boost their client satisfaction.

Here’s how Justin Bilyj, co-author of our book, uses SendOutCards to stay in touch with his Medicare clients:

“Being able to send a card right after the application is taken, then another after they are a client, another cross-selling card for Final Expense three months later, and a renewal card one month before the anniversary helps me keep my clients happy, and I don’t have to do anything but load the name and address into the site.”

A Final Expense agent might design a SendOutCards campaign that looks like this:

- A welcome card sent right after taking an application

- A congratulatory card sent right after the application is approved by underwriting

- A check-in card sent one month after the initial sale to make sure the new customer doesn’t experience buyer’s remorse

- A card sent three months after the initial sale to ask for referrals

- Another card sent six months after the initial sale to cross-sell the customer a Medicare, home health care, or cancer policy

- A reminder card sent after nine months reminding the client that you sell Medicare plans and you’d be happy to see if you can save them on their monthly premium

- Finally, a card sent after 12 months on the policy anniversary to congratulate them, thank them, remind them of the original reason they got the plan, and to ask them for referrals.

After the first year, Final Expense agents typically slow their card campaign to just birthdays and policy renewals to check on customers and ask them for referrals.

A Medicare Supplement agent needs to be a bit more proactive after the first year, because they have to deal with renewals and questions from clients who are experiencing rate hikes or taking new medications that their Part D prescription drug plan (PDP) doesn’t cover – and wondering why one new prescription (to a drug like Victoza) is costing them an extra $5,000 OOP a year.

Because questions like this are more frequent with Medicare Supplement customers, these agents need a consistent on-going touch strategy with clients that might look like this:

- A welcome card sent right after taking an application

- A congratulatory card sent right after the application is approved by underwriting

- A check-in card sent one month after the initial sale to make sure the new customer doesn’t experience buyer’s remorse

- A card sent three months after the initial sale to ask for referrals

- Another card sent six months after the initial sale to cross-sell the customer a Final Expense policy (if you haven’t already attempted to cross-sell during policy delivery)

- An “almost-anniversary” card sent one month before the policy anniversary date (or 11 months after the effective date) to congratulate them, thank them, remind them that all policies experience rate increases around the anniversary date (so they should be getting theirs soon) and offer to proactively shop the market to keep their rate the lowest it can possibly be

- If you’re able to save them money, send another card asking for referrals – citing your ability to consistently keep rates low

- Depending when you enrolled a client, you might want to send a card right before AEP to set up a time to go over their plan options if you also handle PDPs

In addition to this ongoing touch strategy, you can also send the obligatory holiday and birthday cards, which brings this to 10 touches a year – which should be enough to keep you top-of-mind against other agents who might want to wedge between you and your client.

Here’s an example of how one of the agents in our book, Jeff Cornelius ‘drips’ or conducts “multi-touch” marketing campaign for his Medicare Supplement clients:

“I usually do not ask for referrals. I have a call/mail drip program that starts with a thank you card (with two or three business cards to share with friends) as soon as I send in the application, and a “what to expect next” email. Then I answer any questions via phone about two weeks out, send a summer postcard to stay in touch (around July 4th), birthday card with business cards, AEP letter or postcard, Christmas card with business cards, Happy New Year card that says thanks for your business, along with business cards and a calendar for the fridge.”

Whether you prefer to go the passive route of earning referrals or the more active route of asking for referrals, your ultimate aim is to cultivate the types of relationships with your customers that turn them into raving fans who want to recommend you to their friends and families and acquaintances.

As always, I hope you learned some new scripts and ideas to help you make the most of your lead or marketing budget by cross-selling and obtaining referrals. If there’s another way you cross-sell or ask your clients for referrals, or if you have effective campaign ideas for SendOutCards, join the conversation and share them in the comment section below.

0 Comments