Previously in our sales training blog series, we talked about making the sale with polished Final Expense or Medicare Supplement presentations. We even looked at common objections agents encounter when trying to close leads on a plan. Now we’re going to cover what happens AFTER you make a sale, take an application, and enroll a senior in a plan.

In addition to covering what happens immediately after taking an application, we’re going to go over:

- The 4 Stages of Customer Service

- The 3 Activities to Button-Up the Sale

- The 4 Types of Forms to Give to Prospects

- Why the Policy Delivery is Important

- The 5 P’s of a Policy Delivery

- What’s Involved with Servicing a Final Expense and Medicare Supplement Account

- The Best Tool to Conduct a “Multi-Touch Marketing Campaign”

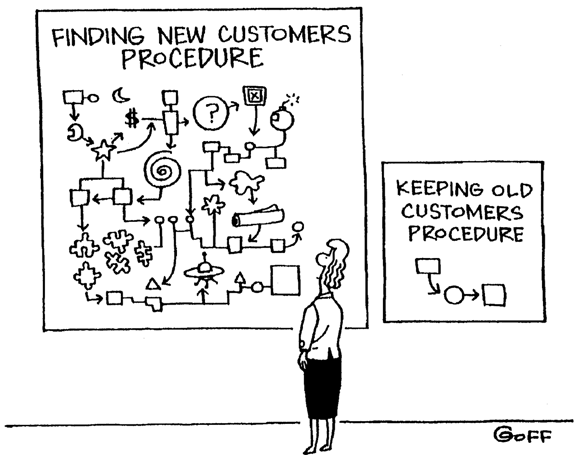

Always remember, it’s much more inexpensive to keep a client on the books than it is to go out and sell somebody new. Understanding good agent service and how to give it is just as important as selling the plan; and both are inextricably linked to your success as an insurance agent.

The easiest way to think of giving good customer service is by understanding the stages that happen after enrolling someone on a plan, whether Final Expense or Medicare Supplements. This article divides the agent’s customer service cycle into 4 stages:

- Button-Up After the Sale

- Policy Delivery

- First 12 Months

- After Year One

Dividing it up into these four stages will help agents understand the particular risks associated with each stage, along with any recommended activities to keep business on the books once you enroll a prospect.

Stage 1: Button-Up After the Sale

The first stage of customer service begins right after the prospect signs the application and enrolls in a plan. Before the agent can go home and collect a commission, he must accomplish three more activities that will help him transition to the next stage of customer service.

1. Building Expectations

You just completed the sale, congratulations! But take a step back and think of this moment from the eyes of the prospect. Chances are they might not be as ecstatic as you are. Rather, they might be concerned about things like:

- Is this agent who he says he is, and is what he says factual? (FE+MS)

- Can I afford the plan? (FE)

- Will my doctor or hospital take my new coverage? (MS)

- Will the plan cover pre-existing conditions? (MS)

- Is the rate or benefit amount guaranteed for the life of the policy? (FE)

- Will the new plan draft correctly and not become a hassle? (FE+MS)

Address any lingering concerns new clients might have by helping build their expectations about what will happen next. Hopefully, you already explained the application process before you signed them up – and even if you did, it’s always helpful to remind prospects “what the drill is” when it comes to the next steps of the process.

Garrett Ball, an insurance agent who collaborated on our book, reminds clients that he’ll walk them through everything if they ever have any questions.

“After you have your plan, I am an ongoing resource for you for as long as you have Medicare. You can call or email me any time, and I can answer any questions that you have related to Medicare.”

Todd King says something similar to his clients after closing a Med Supp deal: “I let them know that I want to be their agent for the rest of their life, and the only way for me to be that agent is for me to make sure they are with a company that isn’t charging them too much, and we can get them switched if the present company has too much of a rate increase. I let them know that I don’t want them to have to pay one more nickel than they have to, as I’m sure they don’t want to either!”

Besides recapping the benefits once more, some other things to cover before you leave may be:

- How long the underwriting process takes

- Any PHI (Phone History Interviews) that need to be done before the policy can be issued

- When coverage starts

- When their account will be billed (either with the application or after policy is issued)

- What happens to their old plan if it’s being replaced

Two other major items to address before wrapping up the sale are: double-checking the paperwork and setting the appointment to go over the policy, either in person or by phone, to answer any questions they may have. Let’s go over those right now.

2. 4 Types of Forms

Once you remind your new customer what’s going to happen next, double-check that you gave them all the proper paperwork. This includes the top four types of forms:

a) Policy replacement paperwork

b) Plan brochure (with any reminder notes on it)

c) Conditional Receipt (for life insurance, if they submit a check)

d) Explanation of benefits (for Medicare Supplements)

Of course, don’t forget to leave your business card as well. In fact, leave a few extra business cards that they can share with others, and have a large business card magnet that they can stick on the fridge as a daily reminder. Some agents even go one step further to help the client enter your number in their phone so they won’t forget it or lose it.

3. Setting the Appointment to Come Back

You’ve built up their expectations, you’ve given them all the required (and recommended) paperwork. The next thing for an agent to do is set up a time to either call them or come back in person to go over the policy they’ve just enrolled in.

Some agents would rather let the company mail out the policy and dust their hands of any activities that aren’t directly adding to their bottom line – in other words, getting back to prospecting and selling again. However, the successful agent understands that this is the best time to solidify any rapport developed in the initial meeting by answering any questions, addressing any concerns, asking for any referrals, and possibly cross-selling them on a different type of insurance.

Whether you sell in person or over the phone, dedicate some time to going over each policy to solidify new business relationships. Make it part of your process. If this isn’t properly done while you have them and their calendar handy, the chances of them agreeing to an appointment later on, when they might be feeling buyer’s remorse, may be nil.

To recap the first stage of customer service, remember:

- Set expectations

- Double-check paperwork and leave the customer copies

- Make an appointment to come back with the policy or to go over it on the phone

If you accomplish these three activities before you leave the customer’s house (or exit the conversation, if you sell over the phone) then you’re on your way to solidifying your sale.

Stage 2: Policy Delivery

The policy delivery is one of the most important post-sale activities that influences whether a customer keeps a plan, builds a more solid relationship with their agent, or considers him referable.

An agent should approach the Policy Delivery stage with 5 P’s in mind:

1. Plan: Go over the plan and its benefits with your client. If you’re delivering a Final Expense plan, explain the guaranteed death benefit amount and the fact that it’s a permanent policy and never going to cancel due to old age. If you’re delivering a Medicare Supplement policy, explain that it’s either the same as their old plan or explain any benefit changes, and emphasize and that their doctors and hospitals will accept the new supplement, either way.

2. Premium: If you’re selling Medicare Supplements, then you want to emphasize the new monthly premium – but not just as a monthly payment amount. It helps to illustrate the annual savings, and even add it up over a few years to show the potential savings, to magnify the value you’re providing. If you’re selling Final Expense plans, then you’ll want to remind the prospect of their monthly obligation and the reasons they took out the plan in the first place. This will help cement the importance of the plan in helping the client’s family avoid a financial burden.

3. Problems: Simply check in with your clients to see if they had questions about anything. If there’s something they aren’t sure of, like whether the premium is still as affordable as they thought initially, then you’ll want to alleviate any concerns. You never know what may be lurking around the corner that might cause a policy to lapse; the successful agent will root that out and make sure the plan sticks.

4. Prospect: Confirm not only that you’ve answered the prospect’s questions and concerns, and that the plan you helped them obtain provides value and accomplishes what they’ve wanted (to protect their family or save money). After confirming, prospect for referrals to lower your marketing budget. (We’ll cover referrals more in a future blog post.)

5. Present: The final P in Policy Delivery is presenting another type of insurance after a sale, known as cross-selling. Agents who want to multiply their commissions while lowering their marketing budgets try to cross-sell other types of insurance to their clients, especially while the trust factor is high and you already have their attention. Cross-selling, which increases policy persistency in already-sold policies, will also be covered more in a future blog post.

Agents who follow these 5 P’s will not only multiply commissions and save on your annual marketing budget, but also decrease lapses while increasing policy persistency. What is persistency, you ask? Well, let’s look at that right now.

Stage 3: First 12 Months

In the previous two stages, we focused on what happens directly after the sale. For stage three, we cover what happens after the sale and before the first 12 months of the policy has eclipsed. The sign of a healthy book of business for an insurance agent is what percentage of his policies stay on the books for the first 12 months of the plan effective date.

Agents want to shoot for a 90%+ persistency rate for their first year. Persistency beyond the first year is much more important to a Medicare Supplement agent than a Final Expense agent, because of the commission difference. Medicare Supplement agents continue to earn the same first year’s commission (FYC), while Final Expense agents earn on average 7-10% of FYC.

Of course, the difference in commission levels also reflect the required amount of service required for the first year and beyond, as we’ll soon see.

Customer Service for Medicare Supplements & Final Expense Agents

The largest difference between Final Expense and Medicare Supplements, besides the commission levels (20% vs 110%), is the amount of service work that’s involved with keeping a client in each respective insurance vertical.

If you’re a Final Expense agent, you’re primarily concerned with getting the customer past the first year without lapsing. After that, it’s not much of a loss, because with a $50 average premium, the agent is only making $5 a month in residual commissions after the first year. Agents who notice a second-year-or-beyond client lapsing won’t shed many tears, because the average new client brings in 10x the commissions as the renewal commissions do. That explains why Final Expense agents are usually preoccupied with bringing in new business as opposed to salvaging lapses.

If you’re a Medicare Supplement agent, though, customer service work never lessens, unless you hire an assistant or support staff. When selling Medicare Supplements, not only is it necessary to have a multi-year touch strategy (which we’ll go over soon), but so is checking in annually with your clients as their monthly premium increases every year. This may require re-shopping and re-enrolling them in a new company every few years to keep rates low. Agents who also help their Medicare Supplement clients with Part D plans will also have to contact them again during the Annual Enrollment Period (AEP) – which is the sanctioned time to review those plans.

Adhering to an annual contact strategy that “touches” a client throughout the year and during AEP will guarantee the Med Supp agent the same FYC he initially earned by signing up that client. Medicare Supplement agents can even find themselves with 6-figure renewals if they have a solid follow-up process in place for keeping clients – and keeping them happy.

Multiple ‘Touches’ Marketing Method

We talked about multiple “touches” in the previous section, but you’re probably wondering what that means. The concept of a “touch” simply means contacting a prospect or client multiple times throughout the year – showing them you’re actively engaged with their case over time. It also keeps them from thinking you’re ignoring them, which makes for happier clients.

Reaching out and contacting your clients multiple times during the year can be effective for:

- Gathering referrals

- Inspiring loyalty

- Cuing remembrance of the reasons they enrolled in the first place

- Preventing lapses

- Cross-selling other insurance products

How and how often you carry out your touch campaigns will vary depending on the type(s) of insurance you sell, the behavior of your niche market, and what your goals are. A sample customer service touch campaign for Final Expense or Medicare Supplements might look like this 5-Step First-Year Plan:

- A thank-you card for taking an application, sent while waiting for the underwriting decision

- A congratulations card sent after they’ve been accepted for a policy

- A reminder email to contact you if they have any questions or concerns, sent one month after a policy is taken out

- A six-month reminder card sent to remind the client of their reason(s) for enrolling

- A one-year celebratory anniversary card that congratulates them on taking action to:

a. Final Expense: protect their family from the financial burden of their final expenses

b. Medicare Supplement: make sure they don’t overspend on their Medigap plan, which can provide them the savings to accomplish X (find X!)

Different agents use different systems to send these cards. Some agents send postcards or more formal greetings cards. Other agents pen hand-written letters, while others stick to email marketing or experiment with SMS texting. If you sell to the senior community, your best mediums will be print formats as opposed to digital ones. Many agents use a service called SendOutCards (SOC), which is unmatched for its effectiveness and capability to automate your touch campaign.

However, we suggest replacing steps 1 & 2 above with a card that you preprint through Vistaprint, and then personalize for each client. The reason being, it takes quite a bit of time to print and mail cards from SOC, which wouldn’t be as effective as mailing a card yourself and having it arrive the next day, as opposed to a week after the day you want it to arrive. This is done to prevent buyer’s remorse which needs a quicker response than SOC, hence Vistaprint in the first month, SOC after that.

Many agents shared their best practices for staying top-of-mind with clients throughout our book. Nathan Robinson likes to “send them informational material throughout the year,” for example, and Todd Graves prefers to “put them on a drip email campaign that reinforces the benefits of having Final Expense and shows cases of what happens to families when some dies without being able to pay for final expenses.”

Mike Smith’s touch strategy for clients after a sale includes “a thank you card, follow-up card, and birthday card to help keep clients on the books. [Sending cards] also helps with establishing rapport and trust from the beginning. But it certainly helps if you have very competitive carriers as well. If you’re typically within $5-$10, then they won’t be replaced. Lapses just happen, but ALWAYS be sure to call your lapses. Sometimes it’s just a simple fix, and you can get them back on the books.”

If you happen to seek referrals or cross-sell other types of insurance, you may have more touches in the first year than the average agent. We’ll cover touch campaigns for referral and cross-selling campaigns in a future blog post.

Chargeback Central

A chargeback happens if a client lapses a policy within the first year, causing the insurance company to request back the FYC it paid you. For some agents, this isn’t a major problem; but for others – especially those that rely on advanced commissions to support themselves and their businesses – it can be a major pain to pay back hundreds of dollars or more in unearned commissions.

Most companies have a as-earned policy for commissions and chargebacks, meaning if a client lapses the policy in the seventh month, you’ll only have to pay back the two months that weren’t earned from the total amount that was advanced to you, assuming a nine-month advance. A wise agent would put 15-20 percent of his commissions to the side to pay for chargebacks if and when they occur.

Agents who fail to pay back lapsed policy advanced commissions can have their names reported to Vector One, a company that insurance companies check before granting a contracting appointment. Getting a Vector report for failure to pay back commissions can hamper your future ability to get contracted, so pay off any chargebacks as soon as they happen.

When it comes to rewriting a first-year lapse, a Final Expense agent has a couple of choices: either rewrite the client with the same company, which means little to no new FYC, or find another company to rewrite them with and earn a new FYC. If the client lapses in year 2 or later, an agent might not miss the small renewal commissions, but a wise Final Expense agent might consider rewriting the lapsed client with a new company and generating a new FYC, provided the rate is similar or cheaper. After all, the agent already went through all the hard work of marketing, building rapport, and taking the initial application with all the pertinent details.

Rewriting a Medicare Supplement policy is usually different than just picking a new company. If Med Supp clients lapse, it’s because another agent tried to lure them away with a company that had a cheaper rate. To rewrite them, you have to win back their loyalty, possibly by agreeing to rewrite them yourself with the cheaper company they found. We won’t go into the reasons why you didn’t recommend the cheaper company in the first place, because it would take is to the quality (rate stability) vs. quantity (premium affordability) argument.

How Agents Prevent Lapses

What would one of our blog posts be without some practical tips and scripts on how other agents prevent lapses? Below are some examples of how some of the collaborators from our book minimize lapses.

Tamara Sasso explains what to do anytime a client lapses: “I try to fix the policy right away, contact the client and try to save the policy in any way that I can. If it can’t be saved, mark the clients to call them back later and try to help them, depending why they cancelled a policy or let it lapse. Sometimes clients don’t realize it, and it just needs to be brought to their attention. Sometimes you need to write them a smaller amount to make their payments easier on their budget. If their budget has changed, etc., find out why and how you can save it or change it. Never be afraid to call or show up on their doorstep.”

When it comes to following up with Medicare Supplement lapses, Jeff Cornelius shares what he says to former clients: “Mary, I noticed that you have decided to replace your Medicare Supplement plan we put in place last year. I was calling to see if you had a problem with your previous plan.” Jeff continues, “If they went with another carrier due to price, I ask if they mind letting me know which company and plan. If I think I can beat the prices I will remind them all plans are the same and provide them a quote with a lower plan if available.”

Brandon Webster likes to reengage clients with the original reason they bought a Final Expense policy to begin with. He says, “I don’t have lapses too often in first year, but when I do, I try to re-engage with the client on the reason we took out a policy in the first place.”

Denise Rangel likes to go further than the original reason the client got the plan. She digs deeper. “First find out what they were thinking when they let their policy go to see if there’s a concern I missed,” she says. “I will stop by and just start a conversation with them to try to find out the reason for the lapse. I try not to sound like I am questioning it, just wait for them to give me the information. Sometimes it works.”

When I was an active insurance agent, my personal belief was that if someone lapses during the first year for Final Expense, I would try to reach out to them via the phone (and possibly email). If I can’t get ahold of them after three attempts, I let it go. Lapses must be apart of your business plan or else you won’t get anywhere.

Loran Marmes shares my opinion about accepting lapses: “I don’t do much to earn them back, I call and ask what more I could have done or if there is something I have done wrong. I make sure they have my number and tell them to call if I can ever be of help. They left me for a reason and I don’t expect that they will be back, but not chasing them seems to work once in a while.”

Philip Arko doesn’t chase down people who left for a cheaper rate, but will respond to them to let them know, “that I can offer the same company if they want and I re-quote them for best rate. If the company they want to switch to has a unstable rate history, I will let them know that.”

Jason McKenzie likes to focus on adjusting the premium draft date to keep Final Expense clients from falling off the books. “Final Expense lapses are something I think every agent struggles with,” he says. “The best way to overcome them, in my opinion, is to stay on top of them. Middleman between them and the company: ‘Do we need to move the draft to another day? Tell me how I can help you make sure you get to keep this valuable coverage.’”

Josh Doe likes to take a more liberal approach when working with prospects who’ve lapsed their policies. “I just let them know I saw they missed a payment and ask why. Then I go from there,” he says. “I won’t try to talk people into keeping it if they say they want to cancel.”

Matt Mungia doesn’t try to keep people from canceling if they truly want to cancel, but he also tries to make an effort to conserve the business. “I call ALL lapses to try and get back on the books,” he says. “Sometimes it’s as simple as the client has a new bank account and forgot to give you the new info. Sometimes you have to go rewrite them. But you MUST try to conserve business, ESPECIALLY starting out.”

Lawrence Malone knows the key to keeping Final Expense policies from lapsing is honing in on a proper premium amount that isn’t too heavy of a burden on the prospect’s finances. He even addresses this when he calls back the client to set up a time to renegotiate a more affordable premium:

“Mr./Mrs. Jones, was the premiums a bit too much? Well, I’m going to be back in the area tomorrow. We’re going to create a plan that will be more affordable for you. Does 10 a.m. or 3 p.m. work best for you?”

Frank Bahr also takes the sympathetic approach by asking clients, “What happened? Did you change banks or get overwhelmed with expenses? Do we need to change the due date or decrease the monthly premium?”

Mark Barendt understands sometimes it’s the premium and sometimes it’s something else. “I try to find out why the change of mind or if there is been a change in finances,” he says. “If there has been a change in finances, I try to make sure that an affordable alternative is offered.”

Brandon Webster is also proactive about finding out what caused the prospect to lapse. “I try to set a new appointment to go over budget again, and to re-sell the need for the insurance, see if anything has changed in the client’s life.”

Jason Eichmiller feels similarly about getting to the root of the problem with the prospect. “Lapses happen,” he says. “I contact them, very persistently (a dollar saved is a dollar earned) and figure out what went wrong. Did they lose their job, or change bank accounts or was it too much money? Then, I let them know that I care about them and their family, and that I’ll do everything in my power to make sure they are affordably protected.”

Many agents from our book said they experienced very few lapses, if any. Lapses are even rarer amongr Medicare Supplement agents, because they’re saving prospects money, whereas Final Expense agents are basically selling prospects a new bill (unless they’re replacing an uncompetitive policy).

Clients are less likely to cancel when you save them money than when you sell them a new expense. Tom Massey echoes that when he says: “To tell you the truth, my Medicare Supplements don’t get replaced. I tell them when they buy that I take on the lower priced supplements when they come out and will give them the chance to switch as their premiums increase. I keep in touch and if my client’s supplement starts to get high, I give them the opportunity to change.”

Of course, you can just avoid chasing lapses by being proactive like Robin Penrod. He says, “I call 30 to 40 clients a week. A quick call, ‘Hi, how are you? Is everything going okay? Is there anything I can help you with?’ It’s a five-minute conversation or a one-minute phone mail message.”

Stage 4: After Year One

This is where selling Final Expense and Medicare Supplements start to differ greatly. After the first year, the Final Expense agent doesn’t have to worry about chargebacks, so his concerns about keeping clients on plans start to ebb. A Medicare Supp agent, on the other hand, will have the same amount of work to keep clients every year, year after year.

This means every Medicare Supp client demands a certain amount of customer service every year for the agent to deserve the same FYC. Cumulatively, this leaves agents with less time to prospect for new business, unless they hire support staff to accommodate the needs of this long-term clientele. Without support staff, an agent can find himself spinning his wheels by constantly replacing business every year instead of adding to it.

And whatever you do, if you happen to hire support staff, make sure they’re answering the phones happily, greeting prospects and clients nicely, and not leaving people on hold too long while they look up client files – or worse, asking the same set of questions someone else already asked them!

The agents from our book shared their tips above, and now it’s your turn. In the comment section below, let us know how you keep your lapses low and your customers happy.

0 Comments