Everything We Published — and Your Final Chance to Save the ‘SuppsThis month has been all about one mission: Save the ‘Supps. Medicare Supplement Plans are under...

Everything We Published — and Your Final Chance to Save the ‘SuppsThis month has been all about one mission: Save the ‘Supps. Medicare Supplement Plans are under...

Welcome back to Medicare Supplement Awareness Month — running from October 1st to October 31st, where our mission is simple: Save the Supps. Every Med Supp policy...

In the ever-changing world of insurance, there’s one thing you can count on — markets shift. Maybe your local market got hit hard. Maybe competition’s tightening, or...

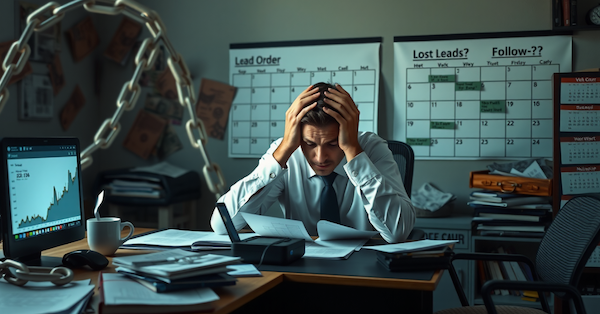

In today’s fast-paced insurance and sales world, speed and consistency are everything. You can have the best leads, the best pitch, and even the best team—but if you...

If you’ve ever tried quoting a Medicare Supplement plan manually, you know how frustrating it can be.Endless rate sheets. Confusing carrier websites. Constantly...

If you’ve ever looked at Medicare Supplement (Medigap) premiums and thought,“Wow, how can this carrier afford to sell that low?”—you’re not imagining things. You’ve...

Let’s face it — Medicare Supplement (Med Supp) isn’t the wide-open opportunity it once was. As Christian Brindle and Glen Shelton recently discussed, Med Supp is...

If you’ve been in sales for more than five minutes, you already know this truth:Prospects rarely say “yes” right away. They hesitate.They stall.They say, “I need to...

If you’ve been in insurance sales long enough, you’ve probably seen this story play out again and again — maybe even in your own business. An agent starts buying leads....