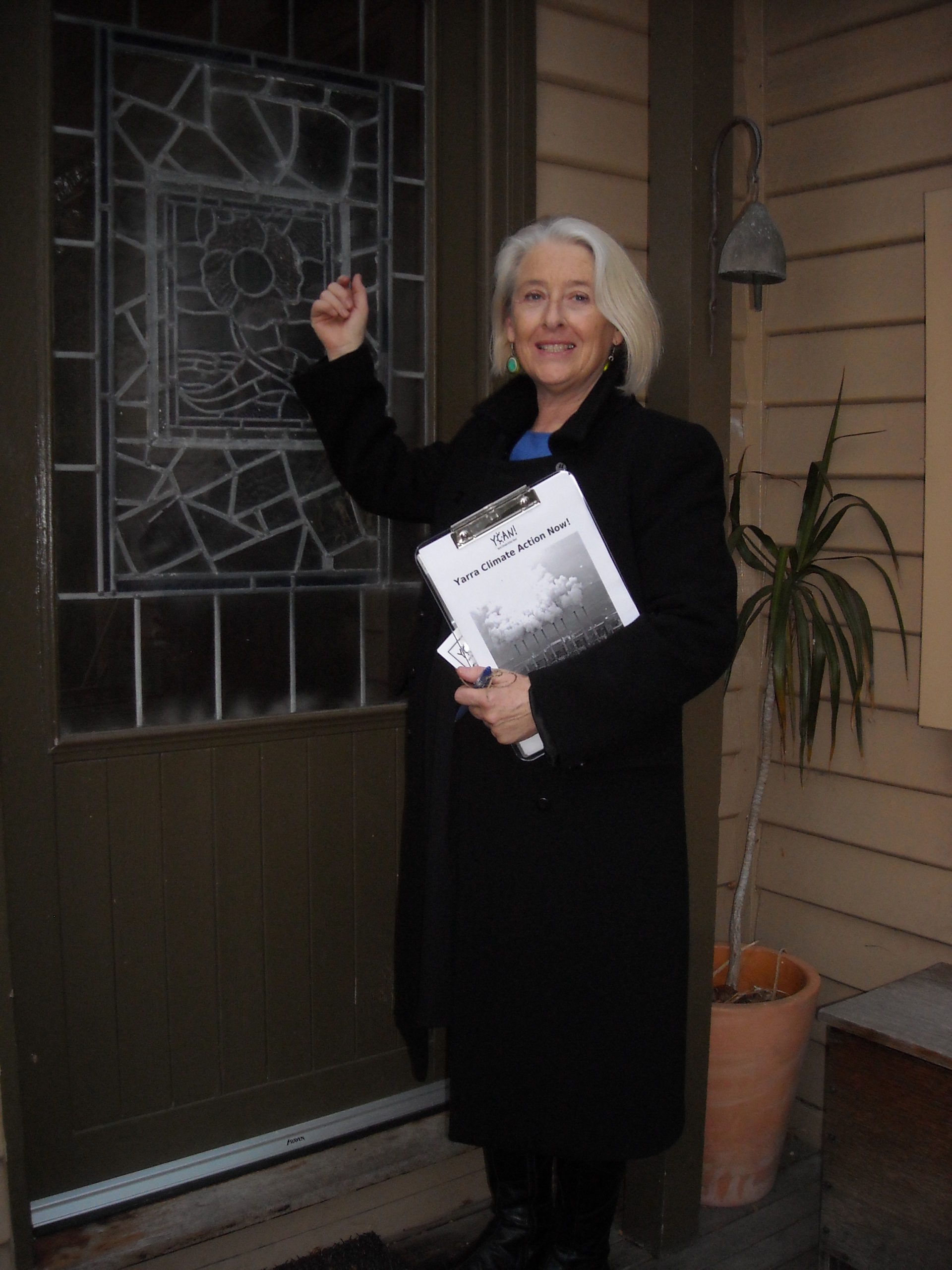

Today we will be looking at what some refer to as cold door knocking, canvassing, farming, or as it was known in earlier times: “going door to door.” This lead generation technique enablesinsurance agents to prospect for business while minimizing lead generation expenses – a perfect strategy for either new agents on a bootstrap budget, or for agents wanting to maximize their pipeline while working other leads generated by other means.

Our first post in this series, The Advanced Guide to Leads, we looked at free leads, how to get them, find them, generate them, and some precautions when taking free lead opportunities in exchange for lower commissions. In this post, we’ll be looking at:

- What door knocking is

- Reasons why agents would want to cold door knock to prospect

- What kinds of insurance you can canvass for

- What kind of metrics an agent can expect when it comes to number of leads generated per number of houses visited and contacts made

- The pros and cons of door knocking compared to other lead generation techniques

- What to say when approaching prospects

In addition to the above, we’ll also go over 30 door-knocking tips to tilt the odds in the agent’s favor when it comes to getting in the door and making a sale.

What is Cold Door Knocking?

To explain what cold door knocking is, we need to examine what door knocking used to be. For most of the 20th Century, insurance was sold door-to-door. An agent would come and knock on your door, much like the milkman, the postman, the census taker, or other door-to-door service professionals. There was no internet, cell phones, fax machines; all business was transacted personally through an agent who would come to your home or business, pick up the premium, and possibly try to sell you more coverage.

Does Door Knocking Even Work Anymore?

You are probably wondering: it’s almost 2017, everyone buys their milk from the supermarket, the census never comes around; is this even a viable method of marketing? I am here to say: yes, for a few reasons AND that going door-to-door or cold door knocking is a legitimate and lost art form.

The first reason is that certain products (like insurance) can still be appropriately positioned via direct cold prospecting. According to Platinum Advertising, the products and services best-suited to sell door-to-door are split into two types:

- Products that “generate a high lifetime customer value” like travel, solar installation and financing, food delivery, lawn services, pest control products, magazine subscriptions, home alarm and security services, and cable TV and internet services.

- Products that “lend themselves to consultation or demonstration — either to explain how the offering differs from that of competitors or to provide instruction — the one-on-one interaction afforded by door-to-door sales gives this approach an advantage over the store environment.” These include beauty care products, cleaning supplies and equipment, cutlery, retail energy, insurance products, and personal investment services like Edward Jones.

The second reason door-to-door sales are still viable is because there are companies still making money doing this! Robert Hartline of CallProof provides us with an interesting take:

“Is door to door selling dead? Not by a long shot. In fact, this sales tactic is growing. From 2013 to 2014, U.S. retail sales in the direct selling channel increased 5.5%, bringing in an estimated $34.47 billion, an industry record high. You may try to dismiss this tactic as dated and ineffective, but the fact remains: this is a $34 billion industry still on the rise.”

To get an idea of how big $35 billion is: Black Friday, one of the largest retail shopping days of the year for the country, generates around $50 billion.

The final reason echoes simple mathematics, more specifically, the numbers theory – which basically states that if you knock on enough doors, you will eventually find someone who was about to:

- agree to a quote for insurance from a phone call they just received

- call a phone number shown in a commercial

- fill out and return a direct mailer

- attend a seminar

- search for a local agent, agency, or blog for more information

Of course, the right timing alone isn’t enough to sell insurance. The other part of the equation, according to referral-based marketing coach Sid Walker, is chemistry. If the agent catches the prospect at the right time AND the prospect both likes and trust the agent, then why can’t that agent be successful at prospecting via cold door knocking?

When Do Agents Door Knock?

There are three reasons why an agent will cold prospect door to door for sales,

- The agent is without a lead budget

- The agent is filling out his pipeline while working other leads in the field

- The agent just prefers to go door to door

Let’s examine these three reasons in more depth below.

1. “Why Door Knock When You Can Buy Leads?”

That is the assumption by most agents working leads, that everyone should work warmer leads and attempting anything less (like door knocking) is a sure way to fail in the industry. Sure, ideally every agent would have sufficient start-up capital to purchase leads out of the gate until they can start building up sales and prospects organically, but unfortunately, some agents just don’t have access to that capital. Some don’t want to wait or can’t wait until they have a budget for leads.

Working on a bootstrap budget isn’t impossible; it just makes things tougher and sometimes more improbable. Instead of working with warm leads who are either interested or open to solving whatever problem addressed by the insurance you’re selling, you must now weed through cold prospects to see who is interested or open to your pitch.

Obviously, not everyone will be ready to buy when you knock on their door; some may be at other stages of the buyer’s cycle. There are 4 major parts to the insurance buyer’s cycle:

- Awareness of a problem

- Comparing options

- Enrolling in a plan

- Assessing value

Where most lead generation techniques address people in stage 1 who have expressed interest in solving a problem, agents who pursue cold door knocking have to weed through people who haven’t even entered the buying cycle yet.

In essence, the door-knocking agent is acting as the point of contact instead of letting a direct mail letter, a phone call from a telemarketing company, or an internet display/text ad do it for you. Because of this “sorting” of suspects into prospects, which can take a lot of time and energy, agents commonly recommend other lead generation techniques that let the agent to do what they think an agent should be doing: qualifying and selling.

2. “If You’re Not Selling, Then You Should Be Prospecting!”

Another reason an agent might door knock is that they want to maximize their time in the field while working other leads or appointments in the area. The only overhead to this is the agent’s time.

In fact, this practice of cold door knocking nearby appointments is often referred to as “the clover technique” or “clovering,” which means cold door knocking the houses across the street and on both sides of your previous appointment (or no-show), while simultaneously using the prospective appointment as a referral technique to solicit familiarity and leverage the herd principle, which can warm a cold lead (depending whether the referral source has returned the clovered prospect’s garden shears from this last summer).

If the agent is on a tight schedule, clovering might not be an option (or a desire), but when the pipeline is half empty and you’re running ahead of schedule, consider door knocking the prospect’s neighbors to see if you can help them with their insurance. It couldn’t hurt.

3. “I Just Like Going Door to Door.”

Some of the most raucous debates within the insurance community contest what’s the better lead option for agents — using direct mail or telemarketed leads? — and what’s the better approach — door knocking or calling to set an appointment? But one of the most intensely debated topics is the effectiveness of door knocking and cold calling.

Some agents at one end of the spectrum say that door knocking is an ineffective prospecting strategy (especially in this day and age). At the other end, you have agents who think cold door knocking is an effective prospecting technique, either because they have or currently prospect door to door for sales, or they believe that sales is a numbers game and that the more people you get in front of, with a process to qualify and convert their interest, then by some law of sales physics, more sales will be made.

Then there are agents who ride the fence and say that if you need to, door knocking can be a helpful way to cold prospect or at least supplement lead orders in the beginning, but they recommend ordering leads to fill your pipeline instead of continuing to door knock long-term, because prospecting and selling isn’t as efficient as outsourcing the prospecting to let agents focusing on selling and client acquisition.

It’s no different than delegating administrative and customer service work to an assistant, to let the agent specialize in selling. Even outsourcing appointment-setting is along the same lines, because it leaves the agent to do what he does best. Ultimately, the outsourcing will continue until he can totally extricate himself from the whole sales process, while he goes golfing or sailing instead of selling at all.

But the third kind of agent who likes to cold door knock does it for other reasons. Maybe he likes the personal touch of introducing the prospect to the agent’s brand in a face-to-face setting, or maybe the agent likes getting out of the office, or finds the phone an incompatible medium for prospecting. Whatever the reason the agent likes to cold door knock, to each their own. We should not dismiss their prospecting strategy and should instead learn from them, because they are a rare special breed of agent that can cold door knock consistently.

Markets an Insurance Agent Can Door Knock

Before an agent goes door knocking, he must figure out the market for his insurance product. Usually the dividing line when it comes to cold prospecting is whether the agent works “residential” or “commercial,” also known as going B2B or cold walking businesses.

An insurance agent wanting to work with in residential or consumer neighborhoods usually prospects for one of four types of insurance:

- Final Expense (permanent life insurance)

- Medicare Supplements

- Mortgage Protection (term life insurance)

- Critical Illness

An insurance agent wanting to work with the business market will find that although the cases can be larger with larger commissions,the sales cycle can be much longer due to a variety of reasons, i.e. business owners can be busy, budget constraints, need, or the number of decision makers involved. The four types of insurance an agent going B2B will offer are usually:

- Life insurance for debt, estate, and survivor income needs

- Disability insurance options including business overhead expense insurance

- Exit Planning needs like buy-sell plans or key man policies

- Employee and executive benefits

We won’t address selling B2B within this article.

Canvassing Metrics

When it comes to door knocking, the metrics to measure success and efficiency are different than those used to measure the effectiveness of cold calling, pay per click ads, or seminars. The four metrics door knockers are most concerned with are:

- Number of Doors: Agents typically need to canvass 40 houses or businesses to meet enough people to present and eventually sell one plan.

- Number of Contacts: For every 40 houses or businesses knocked, agents typically talk to approximately 40-50% of the owners (home or business), which generates about 16-20 prospects.

- Number of Sits: From those 16-20 prospects that you talk to, one-fourth of them will hear you out and listen to your pitch or presentation which is four or five opportunities.

- Number of Sales: From those four or five opportunities, one will emerge the victor and win the opportunity to be your next client.

Basically, the numbers look like this:

- 40 knocks

- 16-20 pitches or approaches

- 4-5 opportunities to fact-find or present

- 1 client

Of course, these numbers could be different for a variety of reasons. The number of door knocks or pitches that an agent needs to filter through to find a prospect might be higher, depending upon the:

- Skill of the agent qualifying the prospect

- Timing of the approach or finding someone who has a need

- Chemistry between prospect and agent

- Budget constraints of the prospect

- Length of sales cycle

Then again, the agent may need fewer knocks if he is more skilled, encounters a prospect that has a spouse or other family member that needs coverage, or if the agent is skilled in soliciting referrals to cut down on the number of prospects that need to be cold door knocked.

The average number of businesses or houses one can prospect at is usually 10 houses or businesses per hour, but that doesn’t factor in time spent qualifying (and hopefully presenting) the interested ones. So, going through 40 knocks may take longer than four hours. If it takes you 20 minutes to qualify a prospect and you are doing four fact findings, that means it will take you almost an additional hour and 20 minutes beyond the original four hours spent knocking. If it takes an additional 40 minutes to present and close, then in total it will take almost six hours to cold prospect 40 homes or businesses. Agents who want to knock more doors in less time should consider tip #23.

We will close the metrics section with a real-life example from a Final Expense agent who door knocks a targeted list successfully, and was kind enough to share his numbers publicly with everyone:

“My average is at least 600AP (annual premium) for every ten doors [I cold knock using a list].

Let’s assume that I get 20 direct mail leads a week, off those leads there are three married couples giving me 26 people to see. I sell 6 policies for 600AP, minus my lead cost that is 3760AP @ 120%.

Now it won’t take me five days to see 20 leads. So, on let’s say two days of the week I just DK my list. I knock 20 doors each day and make 2400AP with no lead cost, that is an additional 125K [a year] with no direct lead cost.”

What are the Pros and Cons of Door Knocking as a Lead Generation Technique?

We collected six pros and six cons for this lead generation technique, which we featured in our insurance sales training book:

PROS CONS

1. Less Overhead 1. No Solicitation Laws

2. Work Outside 2. Consumer Behavior is Evolving

3. Meet Neighbors 3. Physical Exertion

4. Brand Recall is Greater 4. Weather

5. Avoid DNC, SPAM, Ad Blockers 5. Scams

6. Less Competition 6. Hard to Work for Long Periods

PROs of Cold Door Knocking

1. Less Overhead

The biggest pro of door knocking is the same reason why new agents on a shoestring budget default to it. This technique has a low overhead, enabling agents to just walk outside and, within a relatively short period, be knocking on doors, introducing themselves, and potentially helping seniors with their insurance options.

The four hidden costs of long term door knocking are:

- Ordering door hangers for prospects who aren’t home

- Printing flyers to leave with contacts

- Buying comfortable shoes

- Obtaining targeted data lists

Don’t be too concerned with these nominal overhead expenses; after all, door knocking is one of the least expensive methods of prospecting for leads, which is why new agents who can’t afford a consistent lead budget might want to consider door knocking to fill their pipeline.

2. Work Outside

This can be a huge motivator for agents who are stuck in a cubicle or cave of an office. Even agents working from home might have other distractions to navigate, making door knocking total strangers a breeze in the wind compared to the alternatives…

3. Meeting Neighbors

This is a big pro for agents who have a brick-and-mortar office that consumers can walk into. Edward Jones, the financial planning company, mandates that new agents in an area door knock a certain number of people before they can properly claim a territory. Why do they do that? Simple: they want to be known as the go-to financial planning resource for their neighborhood or city. Building a local brand can be amplified by getting out of the office and spreading the word about what you or your company can offer everyone, and nothing beats “pounding the pavement” to drum up brand awareness.

4. Brand Recall Can Be Greater

An article for SmartZip called, “The Surprisingly Simple Art of Door Knocking,” mentions a recent Harvard Study that found: “A face-to-face interaction results in 13 times the brand recall compared to a message delivered via a marketing piece.”

This means agents who door knock or cold canvass can have an opportunity to build trust and make lasting impressions in ways that direct mail and other mass marketing strategies can’t. This is what the insurance agent community refers to as the X trait or characteristic – the ability to build trust that fosters communication with the prospect. The only obstacle to this benefit is time and will of the agent to contact enough prospects and effectively handle the process and high level of rejection that comes with door to door sales.

In the article, “Does Door-to-Door Selling Still Work?” on Safewise.com, Hillary Johnston interviews Johnny Hebda, who has years of experience training door-to-door teams, about the benefits of door-to-door selling and what it has over cold calling:

“A salesperson in the flesh is more likely to be able to build a relationship with a homeowner than someone over the phone. A door-to-door salesperson has the benefit of seeing the kind of house you have, the kind of car you drive, the general décor, and a salesperson has a better opportunity to find common ground with you and build a relationship, rather than just giving you a straight sales pitch.”

Cold calling might produce higher numbers by contacting more people in a short time, but some agents think that door knocking has a distinct advantage – the ability to build a personal connection – which can be harder on the phone than in person.

There’s a lot to be said about adding a personal touch in this day and age, when the convenience of the internet has taken a lot of personal contact out of the buying process.

5. Avoid DNC, SPAM, & Ad Blockers

Naysayers of door-to-door prospecting often point to two consumer behaviors:

a. Consumers not being as receptive to interruptive marketing methods as they are to permissive advertising methods like direct mail or pay-per-click advertising.

b. Consumers being open to attractive marketing methods like content marketing.

We will agree that while other lead gen methods may work more efficiently, even those methods have their own shortcomings as consumer behavior evolves. Cold calling and telemarketing leads will be limited by the Do Not Call (DNC) list and size of area, pay-per-click advertising is halved with the invention of the ad blocker, and content is tough to promote (especially within the financial industry, where common words can easily trip email SPAM filters). The point is, whatever the marketing method, people always find a way to minimize interference.

Even this article from the Associate Press indicates an uptick in door to door sales to beat the evolving consumer behavior:

“While they may not be as effective as telemarketing, door-to-door sales calls are growing in importance.… Other factors besides the do-not-call list have prompted companies to put sales staff back on the street. Unsolicited e-mail annoys most computer users, and improved spam-blockers makes the tactic less effective. And it’s hard to persuade customers to visit a company’s Web site.”

6. Less Competition

It takes a strong, rare breed of agent to have the guts and endurance to get out and cold knock prospects … which means there won’t be too many others out there doing this. The inherent pro in having less competition is that this approach can distinguish hardy agents from the competition – emphasizing a more personal touch. It might take longer to saturate a market by pounding pavement than by direct mail, seminars, or telemarketing, but the connections you do make will stand out more because, chances are, you’re the only agent who knocked on their door.

Cons of Cold Door Knocking

1. Do Not Knock Laws & No Solicitation

Nothing can hamper your prospecting more than getting the police called on you while you are out in the field. The best way to avoid this is to sign up for a solicitor’s license; information is usually on the city government’s website.

Some cities require agents to pay a fee, some require you to notify the local authorities or sign up for a permit, other cities don’t care and don’t have any laws.

At business or consumer residences, if there’s a “no solicitation” sign posted, it’s probably best to avoid the place. However, some agents in the industry who think that the signs don’t apply to them, or that the signs just mean that the prospect doesn’t know how to say NO to salesmen, which is why they put the sign out. We here at the Lead Heroes blog can only recommend that agents follow local laws; beyond that, you have to decide how you will approach prospecting in the field.

2. Consumer Behavior is Evolving

Consumer behavior is changing rapidly, forcing a large share of prospects online to find more information. Although we recommend all agents own a website and write intriguing content that will lure prospects through a sales funnel, sadly, many don’t have the time or money to entertain such projects – which leaves door knocking as a viable method to meet prospects. Even in this digital age when it only takes a few clicks to submit (and respond to) internet quotes and inquiries, agents have to stay in front of consumers to fill the pipeline however they can – even if it means knocking doors until you can afford a website.

3. Physical Exertion

Not everyone is cut out to walk a few miles a day. Some agents might even have handicaps that prevent them from doing any strenuous work. And then there are those who would rather set appointments or respond to mailers than trudge through neighborhoods looking for prospects and hoping they’re home. If you’re hitting the streets, prepare for the physical exertion of being on your feet all day (not to mention possible wear and tear on your car if you’re using a targeted list). You don’t want to show up on someone’s doorstep sweating, huffing and puffing.

4. Weather

Local weather patterns can dictate an agent’s door knocking schedule. Unless you live in a temperate climate like San Diego, you’ll have to axe several months from your door knocking schedule every year because of extreme temperatures and conditions that aren’t conducive to walking around outdoors. The slippery, snowy days of winter aren’t even the worst of it; walking the streets in 90-degree heat can be just as miserable.

Depending on your location, you may only end up with four or five fair-weather months to door knock (around May – June and September – October) unless you get lucky enough to squeeze a few weeks of prospecting in around some unseasonably warm temps. Whatever the weather circumstances in your part of the country (we aren’t talking to you, San Diego), half of the year might not be an option to cold door knock, unless you are a die-hard go-getter.

5. Scams

When door knocking residential areas to sell insurance, be aware of skepticism. Consumers are constantly seeing examples on TV about people, particularly seniors, who fall prey to scams and financial fraud. That doesn’t mean no one will open the door, but it means that some of them who do may greet you with a more critical eye.

An article on Business2Community lists the top four reasons why door knocking isn’t popular anymore. Scamming tops the list, followed by the ability to shop online, the improved retail settings that now offer products that were traditionally sold door-to-door, and the tendency of people to be more private and reclusive due to technology.

From articles like “How to Handle Door to Door Salesmen” on Get Rich Slowly, where the author exposes the “the tricks and techniques these folks use to get into your home and make the sale” to warning bulletins from the BBB like this Senior Citizen Warning for D2D Scams, consumers are taught to be wary of door-to-door salesmen, scare them off, or avoid them altogether. For example, some of the tips from the blog on Get Rich Slowly include:

- Don’t answer the door

- Don’t let him in

- Get a big dog

(Terrified of dogs? That might be another potential con against door knocking.)

6. Hard to Cold Prospect for Long Periods

If it isn’t the weather, the physical exertion, or the big guard dogs, it’s the constant rejection that eventually deals a blow to an agent’s momentum. It’s the same with cold calling – the ability to monotonously prospect through large numbers of people can be mind-numbing. We’ll talk more about the motivation to overcome this obstacle later in the section of tips for insurance agents who cold door knock.

How Do Insurance Agents Cold Door Knock?

The three main ways that agents approach prospects for door-to-door for insurance sales, from easiest to hardest, are:

- Using Surveys or Priority Reviews

- Using Mailers or Flyers

- Directly Pitching Them

In this section, we’ll look at specific script examples for working all three of these methods. Please note: a few of these scripts are from other industries that sell door to door, to help agents understand the different methods of door knocking that are still effective today for various products and services.

Another side note before we look at these prospecting techniques: It’s essential to understand the difference between what an approach is and what fact-finders are. David Kinder, a financial advisor in California, reminds agents of the difference:

“You need to learn the difference between an approach and a fact-finding session. An approach is a way to qualify people if they have a need, want and can afford a solution to a problem. Fact-finding is about the feelings and facts to help you design a proper solution. It’s more in-depth and takes more time.”

Understand this difference and notice how some techniques combine the two, like Mike Matos’ financial survey below. Which one is better? That depends on the agent’s experience, how many products he’s selling, and the sales cycle for the insurance products he’s selling.

Surveys and Priority Reviews

In this strategy, agents use the excuse or cover of a survey to approach the prospects and find out if they are a suitable prospect. Al Granum, the late insurance prospecting pro who coined the famous 10-3-1 ratio (it takes 10 leads to generate three prospects to get one client), referred to this process as separating prospects from suspects. This method is great for new agents because it deflects the outward fact that they are cold prospecting by using a survey to distract the prospect’s attention.

The survey will vary in form. It can take a minimal form of about three questions, to a more in-depth quasi-fact-finder, to more multiple-choice forms that prospects fill out themselves, like priority planning reviews from The Virtual Assistant or the Cotton Client Acquisition System.

Here’s a short three-question door-knocking script for selling Final Expense from Scott Burke:

“Hi! I’m Bob Smith and I’m a local agent for XYZ agency. I’m in the neighborhood today giving away free ink pens to bring attention to our agency” (hand her a pen)

“Do you mind if I ask you our three survey questions?” (they usually don’t mind)

Question 1 should be a warm up like,”How long have you lived in the Parker City area?”

Question 2 – I like to use, “Do you currently own cemetery spaces?” They will tell you a lot of information with this question. You can gauge if they are planners or if life just happens to them. That will tell where they plan to be buried. They will also tell you if cremation is an option for them.

Question 3– “If you qualify for a low-cost burial insurance plan that would preserve all your other life insurance and savings accounts for your family, is that something you would be interested in?”

After the agent fills out the survey, the next steps are to either sit down immediately or set an appointment to help them with any concerns.

Perhaps the most famous discussion within the insurance industry on going door to door was started by a Final Expense agent turned funeral director, Mike Matos. Mike recommended the survey format because it was a non-threatening way to prospect people while simultaneously taking advantage of the human quirk for allowing quick surveys rather than a direct discussion about a prospect’s situation.

Mike’s advice for agents, especially new ones who might not have a consistent budget for leads, is below, along with his survey and a quick video explaining the process more in depth:

I am getting a lot of night shifters…. stay at home moms…. catching people on the day off. I drive streets until I see an area that looks like there are cars in the drive way. Those are the houses I knock first, with others around them.

In most cases, you will always be a BOTHER to them. At least within the first 30 seconds. You have to sell in stages. Here they go for me.

Stage 1 –

I sell the survey…. they buy when they give me 2 minutes of their time.

Stage 2 –

I sell the second appointment. I will be in the area on xyz day. I have a time open at 10:00. May I provide a free quote. They are already a customer. They have bought from me before, so why not. They buy when they give up 1 hour of their time for my free needs analysis and quote.

Stage 3-

Well since they have bought from me two other times, here goes the opportunity to become my customer the third time when I ask for the sale.

I say something like this,

“Hi, my name is Mike and we are calling upon citizens in the Arkansas county area. We are doing a short survey that will only take 2 minutes or less.”

I use the assumptive close and go straight to the first question. I do not tell them I am an insurance agent until they have answered question 10. I then hand them a card, and explain how my business is different from the others. I then ask for the appointment.

– – – – – – – – – – – – – – – – – –

One More Hint: GET A CLIPBOARD! Take nothing (I mean nothing) to the door but the clipboard and a pen. I guess you can put some cards in your pocket, but only if you are going to give it to them after they answer question 10, while you are asking for the sale.

When they say, “Who is it?” I usually respond with, “Oh, it’s Mike,” or “Mr. Matos,” something of that sort. I like “Oh, it’s Mike,” best because then they feel stupid in most cases. They rarely continue to yell, “Mike who?” They usually always answer the door. I act like they already know me. I act like they are being rude by not opening the door to me.

Financial Planning Survey [DOWNLOAD HERE]

Hi, my name is Mike. I am conducting a short 10-question survey to evaluate how people feel about financial planning for the future. In return for participating in the survey, I want to provide you with this free Final Wishes Planning Guide.

Name_________________________

Marital Status________________________________________

1. How long have you lived in the ________ county area? ____________________________

2. What is the size of your family? __________________________________________________

3. Do you own cemetery property? ________________________________________________

4. How important is planning to you? ____________________________________

5. Do you believe an individual can leave their family too much life insurance? ________________________________________________________________________

6. How do you feel about door-to-door sales agents? ________________________________________________________________________

7. What is your primary choice when purchasing insurance or financial products? (telephone, office, door-to-door agent) ________________________________________________________________________

8. Do you feel that the purchase of life insurance is a wise choice, or a waste of money? ________________________________________________________________________

9. Do you feel that most insurance agents are out for their personal interests rather than the interests of their customer? ________________________________________________________________________

10. Do you have enough money in savings that would replace your salary or the salary of your spouse if you lost your job because you were diagnosed with a critical illness? ________________________________________________________________________

11. How confident are you that you have everything in order that if you died today, your children or spouse would know exactly what to do and have final expense funds available within two or three days of your death? ________________________________________________________________________

Thanks for taking the time, Mr./Mrs. ______ to answer these questions.

Would you mind if I contacted you in a few days to evaluate your current policies and/or offer some free quotes? ________________________________________________________________________

Address______________________________________ Age__________________________________

Tobacco_________________________

Current Health Conditions_____________________________

Telephone number___________________________

email: ___________________________________

Whereas Mike’s survey is long and goes into some fact-finding, which mirrors the Edward Jones’ process for new agents, Scott Burke recommends a different approach: keep it short.

That is more like an appointment fact-finder than a door-to-door survey. The purpose of a door-to-door survey is just to engage them quickly and qualify if they are a prospect or not.

I would knock on the door. Explain who I am, who I’m with and that I’m out knocking on doors in their neighborhood today to raise community awareness about what we do. Then I would hand them a NICE quality pen with our info on it.

Then you ask, “Do you have time to answer a short three-question survey?” They ALWAYS said yes.

1. How long have you lived in the Evansville area? They ramble on about where all they have lived.

2. Do you own cemetery property? Most do. They will tell you all about buying when a parent, child, spouse or sibling died. They bought it years ago when it was real cheap compared to today and that gives you an opportunity to compliment them for planning ahead.

3. How confident are you that you have everything in order that if you died today, your children or spouse would know exactly what to do and have final expense funds available within two or three days of your death (or funeral to soften the question)?

The third question can be modified for what you are looking for: save taxes, avoid probate, etc.

The whole key to my approach is that you are talking to someone in a non-threatening way and basically screening their personality and level of interest in talking to you [read chemistry]. What the exact questions are don’t really matter as long as it doesn’t take but a minute and allows you to size them up, and they to size you up and you either set an appointment or you don’t.

Whichever method you use to survey – lengthy or short – Ben Boman shares his survey below and also a good tip for agents that encounter prospects mentioning who they have their plan through,

Also, when I am doing Market Surveys, I am rarely getting into what type of policy they currently have… but if they do volunteer that information, I am going for the appointment RIGHT THEN! “Oh, I’d be happy to go over that with you! Do you want to sit out here or is inside better?”

…Also, going into what they have on a cold knock usually eliminates making an add-on sale. It usually only gets you business on replacing (which is fine). But when you get appointments and go back from the survey, you can pitch it just as a normal lead.

“What we typically run into when someone answers these surveys and then sets an appointment, it’s for one of three reasons…… “Then you get their WHY…

For those wishing to see Ben’s survey, please click here to view the PDF.

Use Mailers or Flyers to Capture Attention

Another way to prospect door to door is to use a flyer or mailer to capture attention and illustrate the reason why you are there, hopefully inspiring any interest they may have had in what you’re selling.

This method is also less direct than just coming out and asking people if they are all set on insurance, which helps ease into prospecting to mitigate the high level of rejection.

There are two ways agents can utilize a mailer or direct mail piece:

1. Use it to door knock unresponsive leads who didn’t send their card in.

This technique is like clovering, which we talked about earlier, helping the agent fill his time with more qualified prospects because they fit the filters of the lead type he is looking for. The agent will take the mailer, knock the unresponsives, and ask them if they remember receiving the mailer – and while the agent is there, would they want a quote. This technique is by far the most popular technique among agents, with many examples below to show you how others follow up on unresponsive leads.

An example of this is by Louis Rouse:

“I am contacting people about the card they may have recently received concerning final expense and burial insurance. You may remember receiving a card like this one. Well, I take care of that for folks in this area and I would like 5 minutes of your time to provide the information for you. may I step in?”

Once we get to the table, I open the interview process by stating:

“Most people who agree to see me do so for one of three reasons. They have some coverage and feel they need to add to it, they do not have any coverage to protect their family and know they need some, or they have some and they want to compare to make sure they are getting the best deal for their money. Which of those applies to you?”

If prospecting for cancer (insurance):

“I am talking with people in the area about the high cost of cancer. Have you ever known anybody who had cancer?”

Another example of using the mailer to prospect people who haven’t sent it back is from Jim Rardin:

Last week my company mailed out a card like this (show card). We haven’t gotten yours back yet, but I was on your street talking with Mrs. X. While I’m here I can answer any questions you have and give you a quick quote. It’ll only take 5 minutes.

Another example is from Chris, a Final Expense agent:

I knock on the door and ask for the person by name.

“Hi, Linda! I’m Chris. We recently mailed you this card and I wanted to come out and visit with you.”

Now at this point you hand the person the card. I know it is not their card because they didn’t send one back. But these people get so much mail that it doesn’t matter. If the person says, “this isn’t my name,” say, “I know, we mailed this card to you but we haven’t gotten yours back yet. Do you have a few minutes?”

Now, if the person doesn’t say, “this isn’t my name on it,” then simply give them a few seconds to read the lead card that you handed them. Once you feel they have had time to read it, just simply ask, “Do you have a few minutes?”

Continuing with the trend, here’s another independent agent’s script for door knocking unresponsive mailers:

I didn’t have a survey or any freebies. I just smiled, showed them a copy of a Final Expense mailer that we’ve sent out, and I ask if they got one in the mail. They would look it over and I would just simply say, “The card talks about a new Final Expense program for seniors so that their family isn’t left with the burden of those final expenses.”

As they are looking it over or pondering if they had seen it in the mail, I say, “Yeah, some people in the building got them and some people didn’t so my company asked me to follow up on these, do you have something in place for funeral expenses?”

2. Use it to door knock people who didn’t even receive the mailer.

This technique might be considered ethically gray area by assuming that anyone who fits a certain demographic (like being a baby boomer or senior) will most likely have a stack of direct mail pieces, most of which end up in the trash. Agents using this technique act as if they sent the mailer, as in the previous method, and they’re following up to see if the prospect has seen the mailer and offering to provide a quote.

Some agents will even find their competitors’ mailers that were recently sent to their market and use them as if they had originally sent them. Although this is also an ethically gray area, this method is justified by some due to two reasons:

- most mailers all look the same anyway

- your competitor already spent the money to market in that area, why not capitalize on it?

We may not condone all of these methods, but we are here to educate agents on all of the methods others are using, and let them decide how to shape their own approach.

Why Not Be Upfront, Direct and Stop Wasting Time?

This is the question of the battle-hardened agent who prospects for a living. Agents who don’t need a crutch like a flyer, mailer, or survey, instead ask more pointed qualifying questions to mass qualify as many people as possible – hoping the law of numbers pays off.

That isn’t to knock anyone for using a survey, flyer, or mailer; if you work any prospecting strategy consistently, with a process in place to qualify and close prospects, then any method can work – as long as the agent is willing to work it.

Jerard, an insurance agent sharing a “non-direct – direct way” of what works for him, describes his introduction,

“Hi, I’m a local insurance agent and I’m just handing out some cards and meeting new people….”

If they take a card but don’t run back inside, say, “I help people with their life insurance, if you know anyone that may need it….”

Then just let them talk (and) you turn it into a conversation. Take your time and don’t hurry things…. the longer they talk, the more they will warm up to you.

Extra Life Insurance, Anyone?

Citafa, an independent insurance agent, door knocks by directly asking prospects, not about their life insurance needs, but their wants:

“Morning, my name is Bill with ABC Life. Hope I didn’t interrupt your lunch; did I?” (or dinner, etc.)

Continue: “Let me tell you why I stopped by. By the way, is that a 68 Corvette, 65 truck,” or “how did you get those flowers to grow so pretty?” etc.

The reason for changing the subject away from your real purpose of being there is this: remember you said ABC Life, so they know who you are, but in their mind, you’re still a stranger; their mind is sizing you up: are you a bad guy, do you appear innocent; are you a threat of some kind? In other words, the first 12-15 seconds of them hearing and seeing you, they really aren’t paying you much attention. Their mind is on whether to “fight or flight.” Hopefully, a little trust is established so you can continue; if not, they may, say “not interested” and don’t let you go on. That’s OK; they just weren’t looking for you.

After that small conversation about the truck, flowers, etc.; continue: “Again, my name is Bill with ABC Life, and I have one little question I’d like to ask you; most folk already have their life insurance in place, but if you had an extra $5K or $10K that you wanted to leave to someone who you cared about, or did you a great favor and wanted to do something special for them when your time comes, WHO WOULD THAT PERSON BE?”

Now, it’s important that you remain silent until you get them to respond. Once they tell you who that person is, continue, “Well, if you’ve got a minute or two, I can show you how little it cost with my company and that will give you something to think about, and see if you like it. Fair enough?”

Now wait; they may be too busy now and ask can you stop back later; yes, come on in; call me next week.

However, you’ll be shocked on how many people will say, “You’re not going to believe this, but I just got a life insurance brochure out of Sunday’s paper and was going to call them this week; the Lord must have sent you by to see me.”

The advantage of prospecting for additional life insurance, is that instead of emphasizing replacement, as Scott Burke mentioned, it’s just much easier to gain trust when asking about additional coverage than it is when you’re telling prospects that they got a bad deal, and that you will help them save money.

Medicare Supplement T65 & T67 Cold Door Knocking

This next direct script came from Frank Stasny, who sadly is no longer with us. His recommendation for a direct door knocking script for Medicare Supplement agents was:

Introduce yourself, first and last name, as you hand them a business card.

“I just stopped by to introduce myself and drop off some information about the new Plan N that Medicare recently released. Unless your agent stays in touch with you, you may not be aware of it. It is priced about 35% less than the other Med Supp plans. The most attractive part is that you don’t have to answer any health questions to qualify for it.

The plan I’m speaking of is an excellent investment of your premium dollar. I would be glad to explain it further if you have a couple of minutes. My time and the information is free.” (Big smile)

Tom, another independent Medicare agent describes his door knocking process or the turning 65 retirees and for Medicare beneficiaries that have been on Medicare for at least a couple of years,

If they’re turning 65 I say something like,

“Hello Mrs. Jones, my name is Tom and I’m an independent insurance agent representing most of the top Medicare Supplement companies. I see you’re getting ready to get Medicare. You’ll be getting bombarded with mail and phone calls, and I’m here to help save you some confusion and make the process as easy as possible for you. May I come in please”?

If they’re older I say something like,

“Hello Mr. Smith, my name’s Tom and I’m an independent insurance agent. I represent most of the top companies. Due to recent increases in Medicare Supplement premiums, I’ve shown several people in the area how they can save money and keep the same plan/exact same coverage they have now. Do you have a few minutes to see if you can qualify to start saving”?

The main thing is to get a conversation started.

How Other Industries Do It

An example that I would like to share is not from the insurance industry, but goes to show how other industries cold door knock by using the herd principle, free quotes, and cross sales:

My pitch is very simple. “My name is Dan, the owner of Master Care Lawnscape, and we do quite a bit of work in this neighborhood. We’re expanding our business this year and I just wanted to stop and see if you’d be interested in a free quote while I’m here.”

You will get one of 3 things….

- No

- Sure, give me a quote

- Questions….this is what you want.

If they start asking questions, they’re generally interested. This is where you take the time to shine and tell them all the great things you offer. Others won’t ask questions until they see a price.

When someone tells me no, I have a follow-up response. “Even though you’re not interested now, let me leave my card with you anyways. We are one of the only companies in this town that offers vacation cuts. If you’re planning on taking a vacation this summer, give us a call and we’ll take care of your lawn while you’re gone. Oh, by the way, we do a lot more than just cutting lawns. Flip my card over, and you’ll see a list of services we offer. Thanks for your time, and give us a call if we can do anything to help you out.”

Sean McPheat writing for MTDSalesTraining shares the door-to-door script for a will writing service:

“Hello there, sorry for disturbing you, my name is ABC from XYZ services (show card). We’re currently running a special promotion within your area for peace of mind will writing services – could I just ask whether you have a will in place so your loved ones are covered?”

Always end an opening script with a question.

Now that we looked at the three different ways insurance agents (and some other industries) cold door knock prospects with corresponding scripts, let’s look at some tips that will help you get the most out of each visit into the field.

30 Tips to Increase Your Sales from Cold Door Knocking

1. Four Functions of a Flyer

We covered this before: many agents use a flyer with their cold prospecting. Of course, simply handing out flyers won’t bring you business; the reason for having a flyer isn’t so you can wuss out and not ask qualifying questions to prospects to decipher their needs. If possible, include rates on your flyers, which may require permission from the insurance company or companies you are prospecting for.

The flyer serves four functions:

a. As a memory cue to the qualifying conversation you had when you first handed it to the prospect, which can provide call backs later – figure .005% will call back. If the agent hands out flyers with each contact – 40 a day – that means one call back per week. If one-fourth the call backs result in a policy, that’s 12 extra policies a year!

b. To show prospects an indication of price to help them make comparison options, which will nudge them deeper into the consumer buying cycle. This is especially helpful if someone has recently taken out a policy and overpaid; the flyer shows how they could either save money or get more benefit for the same premium.

c. It gives you a reason to contact the prospect, which some agents need before walking up to the prospect’s door.

d. To cross-sell the prospect on other types of insurance the agent may offer if the “door-opener” insurance product fails to garner interest.

We recommend Vistaprint for affordable flyers, especially if printing in color.

Louis Rouse, an independent insurance agent, highlights some reasons why a flyer can be beneficial in an agent’s door-to-door process:

When it is evident you are not going to get the interview or the close today and someone asks you to leave info, why not do it? True, most are never going to call you; perhaps 1 out of 100, if you are lucky. But if you don’t leave the info, you are assuring yourself that 100 out of 100 are not going to call. Also by leaving the info, you are leaving it open for a call back.

“Mr. Jones, last time I was here I left you some information and I want to answer any questions you might have if you have had time to review it. But if you haven’t, while I am here I would like to take a few minutes to review it with you.”

Another example of an agent using a flyer (HERE is an example flyer) to introduce himself to people is Justin Bilyj’s door-to-door script:

Intro

Hi, my name is (name), I am talking with folks in the neighborhood to see who doesn’t have a plan to take care of their final expenses. (hand them flyer or marketing piece)

Hook

Do you have life insurance to protect your family from the costs of passing away?

Close

It takes 10 minutes to see what you qualify for, may I come in?

2. Timing Is and Isn’t Everything

Timing is very important going door to door. No matter what, don’t prospect a residence after 8p.m.; that’s just a good overall guideline to follow. How early you should start cold door knocking depends on the market. It isn’t advised to prospect earlier than 9 – 10a.m. for residential neighborhoods.

It also depends on the type of insurance you’re prospecting for. Agents selling critical illness or mortgage protection might get more results prospecting after 4p.m., when the homeowners are home from work. Prospecting before and after lunch usually works for residential door knocking, unless of course the prospect is working, and then again after 4p.m. can be more lucrative. Mondays also can be a hectic day for many, so keep that in mind going out on Mondays, you may find fewer people home.

Many agents are still probably wondering “when is the best time to prospect?” and we must respond – ANYTIME. Anytime is better than not prospecting, and you will find people available at most times. Using an excuse like, “this time isn’t as good so I will avoid door knocking altogether because I won’t yield maximum results,” is the wrong way to think about cold door knocking. If you need to door knock to sustain business, then worrying about the perfect time to prospect will yield little dividends and just contribute to “analysis paralysis.” (For help when you paralyzed, consider the next tip.)

3. Motivate Your Momentum

This tip is crucial to maintaining your momentum when prospecting. Without motivation, agents will quickly burn out and dread the idea of knocking on another door. We have six quick tips for agents who need to recharge their batteries while battling the rejection that comes with prospecting:

a. Show Up: Just showing up is half the battle. Door knocking the first five doors is 75% of the challenge every day – after that, the rest of the day is easy. Courtney Capellan, writing about door-to-door sales for SEMRush, explains why the hardest thing is just showing up:

It’s fascinating how many people will buy something without any real need or reason for it because they were charmed by the salesperson. They’ll also reject a great opportunity if they don’t trust the salesperson. But there’s a lesson here that goes deeper than being conversational.

I’d spend hours rehearsing my pitch. I memorized word for word what I was supposed to say when the door opened. I spoke nervously at first and months later I was still messing it up. On good days, I somehow managed to sign up people for the service I was peddling on their porches.

It’s not about the perfect pitch but the fact that you throw yourself into it. It is the most important lesson that stays with me wherever I go.

Just knock. Show up. Work hard. Start a conversation.

b. Play the Numbers Game: One of the most ingrained laws of sales (or myths, depending who you ask) is that processing higher numbers of people gives agents a better chance of finding people in the market for your product, or uncovering needs along the way.

One of the top motivation books when it comes to insurance sales and prospecting is Nick Murray’s book, “The Game of Numbers,” which focuses on this principle echoed here by insurance agent Mark Rosenthal:

“Do whatever you must to do get in front of people. You must see the people, see the people, see the people. It is a numbers game.”

Citafa, an agent who door knocks for a living, said this about the numbers of door knocking:

Yesterday, many families saw TV ads about getting more/some life insurance; they also received telemarketing phone calls; mail pieces; etc. In other words, their mind has already been “touched” about buying some life insurance in the very near future. Now suddenly, a life insurance agent shows up at the door. What a coincidence!

One more “powerful nugget’ as you’re going door to door, remember these words of wisdom: You’re looking for the one that’s looking for you. The mindset is this, many people have already been thinking about buying some more life insurance on themselves, the kids, grandkids, etc. And suddenly, you’re at their door.You’re the one they’ve been looking for, and that’s who you were looking for, too.

c. Free Prospecting PDF: It’s hard to pick up the phone to make sales calls, let alone getting out of the office to door knock a prospect cold, which is why we recommend reading this PDF by referral coach Sid Walker, “How to Psych Yourself Up to Prospect.” Then after you read it, dedicate yourself to rereading it once a week for a month, then once a month for the rest of the year. This is perhaps the best free motivating PDF, in our opinion.

d. Don’t End on a Sour Note: Linda Schneider, a wealthy realtor who has the best door knocking manual available for free on the internet for realtors, recommends to anyone going door to door to always end the day on a good note, which will set yourself mentally to get out again the next day to prospect.

“Never end on a sour note. If I get a negative comment, I go again and again until I get a positive person and have a positive experience. So often it’s the last door I knock that has the really good lead.”

e. Be Dumb Enough to Do It: That’s former Combined Insurance agent Phil Autelitano’s advice for insurance agents who face going door to door for business. He suggests in his article on Medium to remember a time when you were younger and went door to door for a school cause, a charitable cause, or something like the Boy Scouts of America. By replicating the mindset of a child who is usually impervious to the fears a modern adult has going door to door, he asserts that prospecting is easier if you don’t overthink it, just do it, and have fun with it like a kid would.

f. Look for No’s: A great short instructional book about the concept of flipping the crushing power of NO into a positive experience, the book, “Go For No: Yes is Only the Destination, No is How You Get There,” promotes idea that the more no’s you hear, the closer you are to a yes. Taking this idea further, divide the average number of no’s it takes to write a policy, and you will get the average value of a no.

For example, if you write one $600 annual premium Final Expense policy per 20 contacts, that means the you will hear 19 no’s. An agent can interpret this as if every no is about $30 in his pocket. If he can visit 10 houses in an hour, that’s $300 he can expect to average. Now he can look forward to the no’s, knowing it’s only a matter of time before he gets to a yes.

In addition to these tips, try creating a point system to hold yourself accountable. By assigning a minimum number of points to objectives like making a contact, knocking on a door, setting an appointment, or taking an application – you can embolden yourself to achieve a minimum amount of activity each day that adds up to the point total you were targeting.

Here is how James a Final Expense agent organizes his prospecting activity with points:

Here’s mine for door to door:

- Face to face contact 1 point

- Appointment 0 points (any goof will give an appt and not show wrecking my schedule

- Presentation 10 points (if I get to the kitchen table)

- Sale 20 points

Daily goal is not to get sale but to get 20 points.

Somedays I get in on my 10 o’clock door, write and I’m back in the office by noon drinking coffee and teasing the secretary. My belief is that consistent and measured activity results in consistent sales. I can’t control whether I’ll get a sale or not, but I can control activity, namely contacting.

It takes me 25 contacts at the door to write an app. That figure’s been the same as long as I’ve tracked it. 22 years. Average write up age: 68. Commission per contact: 15 bucks.

Agents wanting more information about prospecting point systems should research Al Granum’s One Card System (OCS) with the following links:

- Brian Anderson’s article on LHP with his personal experience interviewing Al and summarizing his system

- Their 8 page fast planner start guide can be found HERE

- A set of FAQ for the system can be found HERE

- And the first part of their book, Building a Financial Services Clientele

4. Giveaways Buy You Time

Chief among giveaways are cards, magnets, pens, and other brandable items. This technique not only buys you time because prospects will unconsciously want to reciprocate after you give them something, but it allows you to maintain top-of-mind status by casually reminding the prospect of your brand as they go through their day. Hopefully these reminders will help after some life event causes the prospect to rethink their insurance coverages.

One great giveaway idea is a large magnetic business card, which will be perched on prospects’ fridges for years to come. For agents wanting to tip the scales in their favor with local brandability that will inspire call-backs and referrals, invest in magnet business cards.

Citafa, an anonymous insurance agent, recommends magnetic business cards to agents:

Magnetic business cards are very important and not a big expense at all. You purchase the “peel ‘n stick” magnets and place your business card on them. I purchased a lot of 1,000 for about $75-80 in bulk. But for now, go to one of the office supply places and buy pack of about 25 for maybe $10-$15 dollars; do it as you can afford.

Why is this important? Business cards easily get lost, misplaced and tossed. A magnet, however, is never thrown away and goes on the refrigerator.

You get the picture. They may not need or want to talk to you today, but the day that they do, it’s nice to know you have a shot at them contacting “that nice guy they met” way back when.

5. Use First Names

You might be able to use first names to appeal to door-knocked prospects, especially if you use tip #13 or #26. Nothing commands our attention more than hearing our own names, so it provokes more curiosity from prospects to find out how they know this person at their door. This tip is echoed on the Mr. Cold Call blog by, you guessed it, Mr. Cold Call:

So many people fail at cold calling door to door because they don’t know the name of their prospect before they start knocking on doors. Without a name, you are instantly labeled as a salesperson. However, at least if you have a name to offer the receptionist, this begins the sales call with more credibility. It makes you look “smarter” or “trustworthy” in the eyes of the other person.

6. Be Warm and Friendly

This should be common sense: don’t act like a scrooge, even if you hate going door to door – people pick up on that. Be warm, friendly, courteous, act like you are running for office. Combining this tip with the previous tip, using someone’s first name, is perhaps half of the battle, the other half being an intro that qualifies the interest of the prospect. Mike MacDonald on the D2DMillionare blog writes:

A common issue that new sales reps have is low energy. When you are promoting products or services through door-to-door sales, you want to have enough excitement to keep your prospects interested.

When you lack energy around either your products, services, the limited time discount, or deal you are offering, it makes it seem like what you have to offer isn’t that great.

A lack of enthusiasm and energy makes it seem to your prospect that you don’t have something of value, you aren’t confident that your company can deliver, or that the limited discount you have isn’t worth the money.

At the same time, you don’t want to go overboard and come off cheesy, insincere, or worse – canned. MacDonald also adds:

Being a 7 (on a scale of 1 – 10) is key when it comes to maximizing your earnings as a door-to-door sales rep. Being a 7 should be something you shoot for in all aspects of selling door-to-door.

7. Stand Sideways and Look Busy

This is more common sense advice echoed by Paul Shakuri of Door to Door Mastery, a website dedicated to door to door sales (with some insurance-related info), whose YouTube channel features a lot of advice that applies to all industries when it comes to going door to door. The wisdom of this tip comes from the animal kingdom and the more unconscious instincts and behaviors they display. What happens when an animal is scared or about to engage in an attack? They square up and appear formidable, and the result is to frighten off any would-be attackers. This engaged position can frighten anyone peering through a window or peep hole, which will raise the prospect’s guard. It is better to just turn sideways, and appear busy, whether it’s going through your recent leads, metrics, or any other materials on your clipboard.

8. More Than Two Days Out – Send A Note or Card

The recommendation for agents who door knock is to either set an appointment to come back, or get in to present a solution now. If you set an appointment further than one day out, send a card or note thanking the prospect for their time and stating that you look forward to helping them. The idea is to solidify the appointment by inducing reciprocity, which will lead to one of two outcomes:

a. The prospect gets the card and feels guilty to agreeing to the meeting, which they did just to get you to leave, calls you up to back out of the meeting, and then disappears. When this happens, you just spent less than a dollar or two in exchange for not wasting any time chasing this prospect.

b. The prospect gets the card and feels that they made a good choice judging from the professional and personal touch the note created. This will further cement the meeting and create a warmer atmosphere when you arrive for the appointment.

We normally recommend SendOutCards as a card service; unfortunately, their cards take a while to produce and send out, which isn’t ideal if you want to get a note or card to the prospect right away. In a time crunch, we recommend using Vistaprint to mass produce several cards so you have some when you need them.

9. Track Your Metrics

This is perhaps the most neglected tip for agents. An agent who doesn’t track metrics won’t know what to do to get better. Thomas Massey, an insurance agent with a background in direct door-to-door sales, gives agents this tip for tracking your metrics as you go door to door:

You should be able to fit about 40 knocks on each sheet. Write down the street name, then the address numbers as you approach the address. Keep track of Not Homes, Not Interested, Appointments, Presentations & Leads. Then you can break your day down each day and get to know your numbers.

You’ll want a separate sheet to take down lead information. Gather as much data as can and get them agree to a follow-up call. I have a disclaimer on mine that says they authorize a follow-up call by either auto-dial or manual dialing and that by agreeing, this is not a condition of purchase. Have them sign the lead sheet. This creates the ability to build yourself a TCPA compliant list that you can call on for those rainy days.

An easy way to make this printable spreadsheet is by using a program like Excel or Open Office. Thomas also had this to say to agents faced with door knocking to get started:

Don’t be shy. Be confident and friendly. Just get a conversation started at the door and see what direction it leads you. Just like closing, don’t talk too much…get in the door as soon as you can. You need to have thick skin. Don’t let them scare you and don’t let it bother you if they are an ass to you. If they are…next!

Here’s another independent agent’s metrics for door knocking:

It takes me 25 contacts at the door to write an app. That figure’s been the same as long as I’ve tracked it. 22 years. Average write up age: 68. Commission per contact: 15 bucks.

10. Don’t Call It Life Insurance

This tip will be covered a bit more in depth than the other tips, because a large portion of our readers sell life insurance (most them Final Expense).

When approaching life insurance prospects door to door, agents have two ways to sell a Final Expense plan:

- Be direct and ask prospects if they have a need for a plan to pay for their final expenses or would like to save money on their current life insurance plan.

- Be indirect and offer to help prospects plan for their “pre-planning” or “pre-arranging” via a living will or advanced health directive, and then try to sell them a plan afterwards to fund it.

There are three benefits to approaching prospects with the second option:

- The agent is approaching the prospect offering to provide a service free of charge, instead of offering to sell the prospect a plan.

- The agent is providing a service free of charge, which engenders a level of trust with the prospect and promotes a more favorable atmosphere when going over funding solutions.

- The agent is able to demonstrate a valuable service to the prospect that will be more referable than just selling them a plan.

By embracing the second option to help prospects with their pre-planning, agents can distinguish themselves from the competition, who are just “selling life insurance” and not likely providing a valuable (yet free) service.

Another reason this strategy increases persistency is because the prospect often wraps up the funding with the planning in their mind, creating a single plan. The final wishes have a “set it and forget it” effect in the mind of the prospect, which is helpful for both minimizing lapses and promoting referrals.

Agents wanting to read more on this should consult Mark Rosenthal’s site that has more information on this strategy. Also, here’s a nice PDF of a living will that you can use instead.

Another agent was kind enough to share some of his advice for going door to door selling Final Expense life insurance, without calling it life insurance.

Here is your approach at the door in outline form:

- Who you are

- Where you’re from

- What you’re doing (making visits to find out who has planned)

Knock on the door. (Friends knock, salesmen use doorbells). Stand about 10 feet back. When you hear the door open, take a big deep breath; you’re going to need it.

INTRO: “Good morning, I’m Agent with CITY/COMPANY Funeral Planning (hold binder up showing license). Nobody died today (ha ha!) I’m simply making my regular calls in the neighborhood to find out who hasn’t done any funeral planning. Have you done any pre-arranging for yourself?”

FALSE CLOSE” Have you done any planning?”

THEM: “We’ve been kind of thinking about it.”

OR

THEM: “We got that covered.”

OR

THEM: “No thanks.”

OR

THEM: “We’ve got life insurance.”

OR

THEM: (anything, doesn’t matter)

HINGE” That’s fine. That’s all I needed to know.”

You told them why you knocked on their door. That is, to find out who hadn’t done any planning, right? So, this statement, “that’s all I need to know” is a “hinge” in your approach. The “hinge” is very important. The hinge closes off that part of the interview and preserves your credibility at the same time. How? You told them that the reason you came by was to find out something, right? So, if you blast by their response and don’t acknowledge it, then they conclude you’re just another goof selling something. The hinge response confirms that finding out about funeral arrangements really was your reason for knocking on the door. The hinge is your bridge to the next part of your door approach.

SHOW VALUE by suggesting:

“Free of charge, I complete all the planning for you so your family doesn’t have to. It doesn’t cost anything to plan. Most people think it’s a good idea.”

REAL CLOSE and ask:

“May I come in and do that for you?”

It’s not a complete door approach unless you say, “May I come in?” And of course, after, “That’s all I needed to know,” there will be, should be, some shooting the breeze, warm-up stuff; that depends on you.

Here’s my presentation in outline form:

- Intro

- Warm Up (This is a nice comfy kitchen.)

- I tell them what I’m going to do. (I complete all the forms: death cert worksheet, living will, read off)

- Complete the death cert worksheet right after warm up.

“The first form I will complete, Mrs. /Mr. _________, is the death certificate. These are all the questions that the county needs to issue a death certificate. You know all the answers. My experience is that when a death occurs, the adult children forget everything they ever knew. On you birth certificate, what is your first name?”

The living will is often called an advance health care directive. It’s the only way to state whether a person wants to be artificially supported or not. The living will now extends past death giving the agent for health care, noted in the living will, the right of disposition over the body, i.e., the right to control the funeral (each state will vary with legal requirements, which isn’t the agent’s responsibility, you are merely there to help them fill it out so that they have everything started). The living will is the most powerful service part of your presentation.

You’re going to leave the Death Certificate (DC) worksheet and the living will with the prospect. These forms benefit you in two ways: first, marks you as a funeral pro who is providing a service and two, the info on the DC is a lot of what you’re going to need when writing the app.

5. HINGE transition to read-off:

“Mrs./Mr.______, we’ve completed your death certificate and your living will. Now let’s look at funeral planning and then I’ll cost out your arrangements, if you like.”

OR:

“All of your funeral planning is complete, Mrs. /Mr. _________. I can give you an idea of what your arrangements would cost, if you like?”

The read-off can be a basic brochure that talks about the importance of pre-planning so that it doesn’t impact loved ones. It can also illustrate various benefits of a plan that takes care of the funding aspect of the final arrangements. Some of the elements will be the typical three life insurance guarantees: fixed premium, death benefit amount, and permanent.

Go over Read-Off

6. Cost out arrangements. You can add after death expenses or church gifts, etc. on the closing form. Here’s what I say:

“Mrs. /Mr. _________, today’s price for your funeral/cremation is $_____.”

(I point to 10-year inflation)

“In 10 years, it will be $_____.”

“And in 20 years, it will be almost $_____.”

(Circle inflation prices)

“Unless you have a plan like this in place, this is the amount that the funeral director will be asking your family for in full the day after your death. Your plan will pay the funeral home directly. Your family won’t have to go to the funeral home on the worst day of their life and open the checkbook. “

7. Give choice of monthly payments

“Which of these amounts fit your budget/makes the most sense?”

I need to evoke emotion on every call. The emotions that drive pre-need/Final Expense are fear and shame. Either of these emotions will create a buying motive, usually love.

“Mr. /Mrs. _______, as your final arrangements stand now, if you died tonight, Mrs. /Mr. _________ would get a call tomorrow morning from a funeral director downtown saying, ‘Mrs. /Mr. _________, I’m very sorry for your loss. I need you to come in this morning and make arrangements for Mr. _________.’

“Mr. /Mrs. _________, tomorrow morning at about 10 o’clock, Mrs. /Mr. _________ will go to the funeral home. She will be, maybe for the first time in her life, alone, confused and exhausted. She will do all the paperwork. Then she will open her checkbook, and write a big check on the worst day of her life.

But it doesn’t have to be that way, Mrs. /Mr. _________. I need you to write me a check for $____.”

How do I create demand for this? It’s already there, otherwise the prospect wouldn’t let you in. Our job is to intensify that demand. They are worried about their arrangements.

You intensify the demand by focusing on family and money by focusing on two emotions: fear and shame. What drives the FE sale is the fear that the money won’t be there the day after death. You’re looking for a responsible prospect who doesn’t want to dump their arrangements on the kids. Shame is the emotion we feel when we haven’t lived up to our own standards. Good prospect are worried about this.

Like most reps, I’ve done a lousy job getting referrals. Until I figured it out. The key is to make it part of the presentation, not an add-on. The time and place to do it is at the bottom of the DC worksheet. Where it says “people to be notified,” say,

“Mr. /Mrs. _______, who needs to be notified after your death?”

When you’re getting ready to leave, get permission to contact those people as a courtesy, and then offer to complete their pre-arranging as a free value-added service.

Complete Legacy Safeguard Funeral Planning Collection

Agents that would like more information on helping seniors with their final arrangements can also look to the popular Legacy Safeguard system that is touted by many IMOs and insurance companies. Below is everything you need to get started training on the approach similar to the two previous examples, but more in-depth with objections, tips, etc.

Here is a pricing worksheet to discuss final expenses and arrangement costs.

Here is the marketing guide for agents with scripts and tips for using the Legacy Safeguard system.

Here is a more in-depth training guide for agents on presenting the system.

Here is a PowerPoint that summarizes the opportunities of using the Legacy Safeguard system.

Here is another one.

Here is the customer brochure for the free Legacy system.

11. Do the Data Walk

Agents wanting to work smarter rather than harder should organize the flow of their door knocking one of two ways: getting a walking sequence from the data list provider, or filtering the data list by street and hitting the closely clustered streets, making it easier to hit more prospects is less time.

Agents wanting to order the carrier or mailman route should just ask their data provider for that information. For a list of data providers, please consult our previous article that compared the top 10 data vendors for insurance agents.