Previously in our sales training blog series, we looked at selling Final Expense life insurance plans. In this post, we’ll explore the process of selling Medicare Supplements to seniors.

There are two primary ways to sell Medicare Supplements, depending which prospect niche you’ll be qualifying and presenting to:

- Seniors turning 65 and aging into the Medicare system, also known as T65

- Seniors who have already been on Medicare for at least two years and have a Medicare Supplement and most likely at least one rate increase, also known as T67

Both niches have their pros and cons, but suffice to say, T65 is a tougher niche to begin prospecting as a new agent. That’s because of the 4 main reasons:

1. Learning Curve

In addition to learning the complexities of Medicare Supplements, agents also must fully understand how Medicare Advantage and Part D plans work, which requires keeping up on annual updates and changes.

2. Educating Seniors

Not only does the agent have to educate himself but he also has to educate the prospect on the differences between Medicare Advantage and Medicare Supplements, and which option would be better for each person. Medicare is confusing enough to seniors who have been on it for several years, so being the first agent to explain these differences to seniors before they turn 65 requires an even keener understanding of the Medicare system.

3. Compliance

If you prospect T65 seniors and only offer Medicare Supplements, you could be leaving money on the table. But on the flipside, if you diversify and sell Medicare Advantage and Part D plans too, the compliance requirements can be an annual training hassle filled with red tape and constant scrutiny by CMS – not to mention limited avenues with which to market yourself and services.

4. Waiting Period

Agents wanting to prospect T65 seniors often wait at least 4 to 6 months to see consistent commissions because of the marketing cycle of this product. Agents must prospect 3-5 months before seniors turn 65 years old to establish a relationship and compare options. That is the time when most seniors make up their minds about which plan option to enroll in.

Because of those 4 reasons, we recommend that new insurance agents start off prospecting T67 seniors, so you can stick to saving them money and providing top notch service. That’s what we’ll focus on in this blog post.

Everything is Backwards!

Like we covered in our last blog, the Final Expense sales process for qualifying leads is:

- Need

- Budget

- Health

But agents qualifying Med Supp prospects follow the opposite order:

- Health

- Budget

- Need

This is because when you’re serving the T67 niche, you can safely assume that they have a need to save money on their Medicare Supplement, because they’ve probably experienced a rate increase or two by then. Final Expense agents, on the other hand, aren’t sure when they’re qualifying whether a prospect has a plan or not, or whether they’re looking to save money or add more coverage – which is why it’s more important for Final Expense agents to start by qualifying need rather than health.

Of course, not all agents follow this formula. For example, Med Supp agent Phillip Arko qualifies the lead’s need first by finding out where their current plan is falling short with two key questions:

“What do you like most about your current supplement?” and then, “What do you least like about your current supplement?”

The more efficient an agent’s trying to be with his time, the more he’ll try to prequalify leads as much upfront before presenting and comparing quotes.

Garrett Ball pre-closes by asking upfront if leads are interested in saving money:

“Would it help your budget to reduce what you are paying while keeping the same coverage?”

So, when reading this post, use the order of these steps as more of a guide to the major parts of a Medicare Supplement presentation. Some agents will do things differently, and we invite you to explore what works best for you to help close more sales.

1. Qualifying Health

For Medicare Supplement agents, qualifying a lead begins with health, especially if you’re selling over the phone (OTP).

These are the health qualification questions you want to explore with the prospect:

- Have you had within the last 3-5 years a heart attack, stroke or cancer? (also, known as the big 3)

- Have you been hospitalized 2 or more times in the last 2 years?

- Are you relatively healthy or do you take any medications?

These three questions should give you enough info to paint a picture or start a conversation on whether a prospect will pass underwriting with Med Supp companies.

Joseph Smith likes to qualify a lead’s health in the beginning before proceeding to budget, by asking:

“What alphabet letter plan they have, their rate, height, weight, whether they are a smoker or non-smoker, then I ask five basic medical questions (diabetes, COPD, heart issues, cancer, and any upcoming surgeries).”

Tom Massey explains to the lead why he asks health questions first,

“I represent over 15 of the main Medicare Supplement companies and they all underwrite differently. I need to know what medications you take and what major health conditions you’ve been treated for in the past three years so I can see how much money I can save you for the exact coverage you have now.”

For more examples on qualifying a Med Supp lead’s health, check out our blog about initially contacting leads where we dive into that when calling over the phone.

Declinable Conditions

Before agents start selling Medicare Supplements, they should do a little background research in the locations where they’ll be prospecting. That means running quotes for female and males, with and without the “household discount,” for every 5 age bands starting at 65. Don’t forget to include smoking to see how the rates can change.

What you will find is the same top 5 companies showing up across those age and health differences. The next step is for the agent to take those companies’ underwriting applications and compare the questions to see which health conditions result in an auto decline, such as cancer within 2 years, lymphoma, multiple sclerosis, COPD, neuropathy, amputation, etc.

If you have CSG Actuarial (who won the senior health agent niche recommendation in our recent blog post review of Quoting Tools) you can plug in different health conditions to see which companies might accept certain health conditions, or rate them up like Equitable or Cigna do.

Enrollment Periods

Seniors are allowed a few “get out of jail free cards,” so to speak, which allow them to bypass any health underwriting a Medicare Supplement company may have. Each event that allows this free pass has conditions attached to it.

There are numerous enrollment periods when seniors can enroll in Medicare Supplements, but for the most part, agents should concern themselves primarily with these three enrollment periods:

1. Annual Enrollment Period: This period happens every year starting on October 15th and goes through December 7th. During AEP, seniors can enroll in a Medicare Advantage plan or Part D prescription plan. For some reason, seniors are conditioned to erroneously believing they can only change supplements during this time of year, but they can enroll in supplements anytime they can pass underwriting.

2. Guaranteed Issue: This period happens whenever a senior comes off a group health insurance plan or Medicaid. They can pick any Plan F of their choice without going through underwriting. They can also choose Plan A, C, K or L – but most seniors go with F. Also, be aware that commissions may be reduced by insurance companies for GI business.

3. Initial Open Enrollment: This period lasts 3 months before the month a prospect turns 65 and 3 months after their birth month, giving them 7 total months to shop for a Medicare Supplement without underwriting. During this time, they can choose ANY Medicare Supplement plan without answering the health questions. For prospects with chronic health conditions, take special care to educate them and let them know they won’t be able to change plans as easily, if at all (depending on their conditions and medications) – be prudent when selecting a plan and company that traditionally have stable or low rate increases.

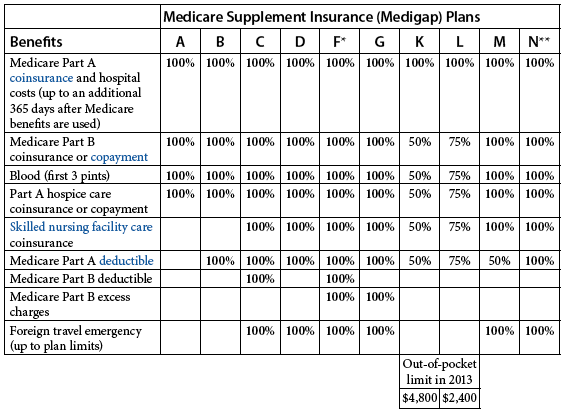

For a more detailed look at the various enrollment periods, look at the chart below:

When you understand the top 5 companies’ health underwriting intricacies and which enrollment period may apply to a prospect, you can more effectively qualify a lead’s health.

2. Qualifying Budget

After an agent qualifies a Medicare lead’s health status, he can proceed to qualifying the lead’s budget by comparing plan options for the senior. But before you start taking them through their options, you first must educate them on the mechanics of Med Supps, so they can understand what they’re about to see.

An easy way to understand the process for qualifying a Medigap lead’s budget is called ETA: Expert, Trust, Authority.

Becoming an Expert

The Expert step in the qualifying budget stage is by educating the lead on three topics:

- Benefits: Start by explaining that all Medicare Supplement plans are federally standardized to have the same benefits from company to company; the only difference is the price they pay. (Be sure to reference the page of the “Medicare & You Guidebook” that references this to help establish credibility). Of course, they can change benefit plans by going from a Plan F to a Plan G or even to a Plan N. But you don’t have to get into that just yet, especially if you sell OTP; just focus on getting them acquainted with the main guarantee of Medigap plans – the standardization of benefits. Covering this topic can help prevent the objection of “I don’t want to lose my benefits.”

- Network: The next point to cover is that there are no networks for Medigap beneficiaries to worry about (not counting Medicare Supplement Select plans). That means every doctor and hospital that accept Medicare patients must take this plan also. By going over this point, you can can help eliminate the objection of “Will my doctor or hospital take this insurance?”

- Billing: The next point for agents to cover is how the billing works for Medicare Supplements, because one of the greatest fears a Med Supp prospect has is whether the company will cover them if they get sick or have an accident. Explain to them that Medigap companies are bound by law to pay all claims covered by Medicare, and that Medicare gets the bill first before sending it to the Medigap company, who pays the rest for the consumer. The company can’t just decide not to not cover them if something happens. This will eliminate the objection of “Will the company pay all the bills?”

An agent who covers these three topics sets himself up as an Expert who clearly understands the ins and outs of Medicare Supplements.

Here’s how some of the contributors in our book handle educating prospects on these topics:

Todd R. King cultivates trust and rapport by explaining how Medicare actually works, which distinguishes him from other agents who skip over this misunderstood subject:

“I simply educate the prospect on how their bills get paid by Medicare and the insurance company. Most will say they’ve never had that explained to them. That’s where you really build trust explaining how billing and Medicare work.”

Robin Penrod educates Med Supp leads by using the “Medicare & You Guidebook”:

“I ask if they have the ‘Medicare & You’ book, where I point out specific pages to discuss. If they have an email, I will email this to them. I use Wonder Bread as an example:

“Walmart may sell it for $1.50, but Kroger may sell the same loaf of Wonder Bread for $.99. Same bread, same packaging, same benefits, just a different price.”

“It is a simple example, the senior crowd recognizes the name Wonder Bread, it is something they can relate to.”

“Medicare Plan F allows you to see the same doctors, specialists, and hospitals just like Wonder Bread, just paying a better price, because I have shopped for you. No need to drive all over town to get the best price. I know which companies have the lowest cost for the exact same item in their county.”

Justin Bilyj re-educates the prospect with how Medigap plans work:

“While I am researching rates to see if there’s any possible savings for you, did you get the ‘Medicare & You Guidebook’ when you signed up for Medicare? If you are like any of my clients, you probably use it more as a paperweight, but I coach every one of my clients to read it every year as the new edition comes out so they can stay up-to-date with any changes in Medicare.”

“If you turn to this year’s edition, to page 92, you will see that it says right there that all Medicare Supplement companies are required by Federal Law to have the exact same plans with the same benefits, the only difference is the price you pay.”

“So, in other words, a Plan F with Company A or Company B is the same Plan F that Company C or Company D has – the only difference is the monthly premium.”

Loran Marmes uses video to educate and build trust with leads:

“I prefer to email them a video on either Plan G or a basic one on how all Medicare Supplement companies must provide the same benefits. Getting the email is the key, because I will ‘touch’ or contact them around their birthday after they get another rate increase.”

Tom Massey educates Medicare Supplement prospects on the process of saving money on the their Medigap plan insurance, just like auto and home – by re-shopping it every two to three years:

“The benefits of a cheaper Medicare Supplement for a similar Plan F is the monthly savings. I ask prospects, ‘Why pay more for the exact same thing? Whether you’re on a tight budget or just don’t like overpaying for things, you might as well save money when possible.’ I explain that this is common practice with Medicare Supplements, to change about every three years. As the price of supplements go up, new ones with lower premiums come out.”

Jeff Cornelius educates leads about standardization:

“I see that you have a Plan F. What do you like most about your plan? Mr. Smith, I am sure you are aware that by law, all Medicare Supplement plans are the same and the only difference is premium, correct? So, if we can find another Plan F with a lower rate than you are currently paying, which would allow you to have the same sense of protection, just at a lower rate, would that help you out?”

Getting the Lead to Trust You

The second step in qualifying a lead’s budget before showing them plan options or prices is called the Trust step. This is where you go over your background and show the prospect:

- A copy of your insurance license

- A picture or two of you (if you’re doing a screen share)

- Any referrals whether they’re in quotes, picture, or video format.

A couple of items to note about building trust:

a. Agents who do F2F sales will usually get this part of the presentation out of the way during the warm-up before qualifying. For agents who sell OTP, be sure to ask for a prospect’s email so you can “show them everything in black and white,” while you’re on the phone with them. This will allow you to email a screen-share session ID link to the prospect so they can sign on and view your screen as you compare options after going through your background. If you have a quality webcam, turn it on after logging on to the session so they can see who they’re doing business with. This will inspire quite a bit of trust to make them more receptive to your recommendations when comparing plan options.

b. Building trust doesn’t just happen during a certain stage of the sales process; it’s constantly happening. How you dress (or look on camera), your tone of voice and tempo all influence the prospect’s decision to trust you. Strive for self-awareness about how you’re communicating to the prospect throughout the qualifying and presentation process.

Building Authority

The last step in qualifying a lead’s budget for Medigap sales is building Authority. This is the meat and potatoes of qualifying a lead’s budget, where the agent will plug in the lead’s info (if they haven’t already) to see what the savings are.

When it comes to replacing Medigap plans, start byseeing if you can save money on a plan that has the same benefits. If you find savings to similar benefit plans, just stick to selling that option instead of exploring other cheaper plan options. Give it a year, and then on their anniversary when their rate goes up, then go over other plan options (like switching from Plan F to Plan G or N).

If there’s no savings available for a similar plan, try another plan (like G or N) with lower benefits that offer more premium savings. Of course, you should always be mindful of a senior’s annual healthcare needs to determine whether a lower benefit plan with more cost sharing would be wise in the long run.

After going through the differences between Plan F and Plan G, Bob Vineyard asks prospects,

“Would you have a problem paying a company $300 per year to pay a $183 claim?”

Then after comparing Plan G to Plan N, he asks,

“Would you be willing to pay a $20 doc copay if you could save another $200+ year?”

Just showing a prospect some quotes will not make you an authority, but you can become an authority in their eyes by educating them on why the cheapest option isn’t always the best, and what the premium variance is for any given plan in their area. That, combined with stellar client service, is how to become an Authority in the eyes of a prospect – which can also help agents when it comes time to ask for referrals.

After an agent educates leads on their Medigap plan options and recommends which company and plan would be the best fit for the senior’s priorities, then break down the savings associated with your recommendation.

This is where the Medicare Supplements Budget stage differs from Final Expense because defining the budget isn’t about what it will cost the senior but what it will save them – since you’re saving them money on a bill they already have instead of selling them on a new one.

3. Qualifying the Lead’s Need

The third step to qualifying a Medicare Supplement lead is to qualify the need. After breaking down the savings to the prospect, you can seamlessly transition into this step to extrapolate what that savings means to the senior. That, in turn, will give you their true need, besides just saving them money on their insurance.

There are 5 core steps to isolating the need of a Med Supp prospect:

a. Remind them of any previous rate increases they may have mentioned already. This will get them feeling the pain of increasing prices.

b. Remind them that they live on a fixed income. This will add further pressure to any pain they might feel about increasing prices.

c. Reemphasize either the savings with the same benefits or the advantages of switching to a cheaper plan with lower benefits.

d. Rework the potential savings into terms the prospect can understand, either by comparing the amount they’re overpaying to another monthly bill (like an extra car payment) or compiling the savings over two or three years to illustrate how it adds up over time.

e. Ask them what those savings mean to them or what they will do with the extra money to help them internalize the change.

That last step is perhaps one of the most important parts of the presentation, but you can’t rush it. If you get to this point, where the prospect is open to telling you how they’ll use the extra money, it means they’re feeling ownership over the potential savings and closing themselves. You know you made the sale. The lead will only level with you by confiding what the savings truly mean to them if they trust you and your recommendation. If they stall or sputter, it means they don’t trust you enough or the savings just aren’t worth the hassle of changing plans or providers.

Jeff Cornelius breaks down the plans and premium differences in one fell swoop:

“First, I review the Medicare Supplement standardized plan chart. Usually, we have highlighted Plan F, G, and N. When looking at the differences with Plan F vs. Plan G, I have clients write down the annual cost of the Plan F Medicare Supplement, which in this example was $1,560. Then I have them write down the annual premium for a Plan G, which happens to be $1,200. I then ask them what the cost difference is, $360, so I point out that Plan F is asking them to pay $360 more to save them from paying a [then] $166 Part B deductible.”

Joseph Smith finds it effective to get leads involved with calculating their savings to drive the point home:

“When it comes to comparing Plan F and Plan G, I have prospects write down their current plan and the cost of a Plan G with paying the deductible. Then I ask them to do the arithmetic and ask them to choose which plan they’d rather have.”

Referencing past price increases can be especially effective with prospects who don’t use their healthcare plan a lot. For example, Jeff Erb asks prospects:

“How does it make you feel to have that significant of a price increase (or pay that much every month) when you have not really used your plan at all?”

Robin Penrod qualifies the savings in terms of what it might allow the senior to accomplish:

“With regards to their budget, I generally emphasize that we are all on fixed incomes and a savings of $X per moth provides extra income for other necessities or a trip to see the grandkids, etc. I also listen as we are talking and try to find a good reason why to change, and then loop it back to that hot spot when closing.”

Jason McKenzie will reference the fixed income aspect of retirement to isolate the need of a prospect:

“Mr. or Mrs. Jones, Social Security isn’t going to give you a substantial raise; we know that. I’m offering you a $X per month raise starting next month. We can all use a little extra each month…”

Justin Bilyj quotes the prospect and then quantifies the savings by gauging what that amount means to them:

“Based on what you told me, Ms. Jones, and looking at all the companies in the state that have plans for your area, you should be paying $X per month for:

Plan F: “…the exact same plan, which has the exact same benefits, same doctors, and same hospitals.

Plan G: “…a Plan G, which as I said, is almost identical to the Plan F, except for the annual Part B deductible, which is $X. After the deductible has been satisfied, the Plan G acts like a Plan F for the rest of the year, covering everything like your current plan does.”

“This is an annual savings of $X per year for your family, which is about $X in three years. What would you do with that extra money going back into your pocket every month?”

Debbie Majher qualifies a lead’s budget in terms of the possible savings available:

“What kinds of things could do with that extra money in your pocket each month? Since you’re on a fixed income, would an extra $X a month help you meet your needs?”

Jacob Anderson uses the savings as a bridge into closing the sale:

“Mr. Jones, Social Security didn’t give a cost of living raise this year. Lowering your monthly premiums by $40, $50 or more can effectively give you more discretionary spending, which will help you with your other expenses. Would this help you?”

After they say ‘yes’ I would say,

“Good. Let’s take a few minutes and see what you qualify for.”

Closing Medicare Supplement Leads

So, let’s recap for a second:

- You qualified the prospect’s health and know they can pass underwriting (or at least you have a pretty good idea that they will)

- You qualified their budget by following the ETA process

- Then you qualified their need by highlighting the potential savings and what that means to them

After following these steps, there’s only one thing left to do – close the sale. To do this, first walk them through how the application process works to dispel the last remaining objection, “How does this work and will I lose my plan?”

Basically, you want to explain to them the 6 parts of enrolling:

- The application process takes 15 minutes.

- The agent will ask the prospect more in-depth health questions to make sure they qualify for the savings (but you should have prequalified their health in the beginning!)

- After you submit the application, it takes approximately 3-5 days for the company to call the lead up to reverify their answers if the application is submitted electronically, 7 days by fax, or 14 days by mail.

- After the insurance company reverifies the lead’s health and checks their medical records during the Phone Health Interview, they will approve the policy.

- Depending on the company and how they process premiums, the first month’s premium may be drafted after the Phone Health Interview, when submitting the application, or on the chosen draft date.

- When the plan drafts the first month’s premium, the company will generally send the policy to the client, at which time you will call them back up and go over it with them – or the company will send it to you and you will come out and deliver it.

After you go through this process, use the Frank Stasny close: “All I need to get this started is for you to grab your red, white, and blue card,” which is the same technique Justin Bilyj uses to close leads:

“Ms. Jones, the whole application process is easy and seamless. I do everything here on my end, I submit the application to the company, and they will call you within a day or two to confirm the health questions we just went over. After they call you to confirm the health questions, it generally takes about two to three days to find out if you have been accepted or declined.”

It’s important to note, Ms. Jones, no one’s going to cancel your old policy until you have your new policy in hand and you see:

Plan F: …That it’s the exact same plan, same benefits, just at a lower, more affordable monthly amount.

Plan G: …That the plan is a Plan G, which takes all your same doctors and hospitals, and that it’s identical to your Plan F, except you must pay the annual deductible – after that, the plan acts like a Plan F for the rest of the year.

After you’re assured that everything is the same, we can call up your old coverage to tell them you don’t need them anymore so you aren’t double billed.

All I need to get this started is for you to get your red, white, and blue card…”

After that statement, you will either have a new objection to deal with or a new client giving you their information to fill out the application.

We’ll cover how to handle objections more in-depth in the next post in this series.

If you have any lines that work well for you to help you to educate and sell Medicare Supplement leads, please post them below in the comments section.

Thank you for this information, it was great and much needed.