There are 5,380 Final Expense insurance jobs currently available on LinkedIn, and 2,571 Medicare agent job positions. This doesn’t even include all of the insurance job listings you’ll find on other job boards like CareerBuilder, Indeed, Glassdoor, Simply Hired, ZipRecruiter, Monster, Craigslist or InsuranceCareer.com.

Hiring insurance agents for the senior market is HOT BUSINESS right now.

But which type of insurance should you sell? In our book, “How to Qualify, Present & Sell Final Expense and Medicare Supplements to Seniors,” we talk about the four significant differences between selling Final Expense and Medicare Supplements, which are:

- Size and duration of commissions

- Type of selling environment

- How long it takes the agent to understand that particular type of insurance

- The amount of customer service needed by the agent to keep clients on the books

The debate rages on in the insurance industry about which type of insurance is better to sell, which type of insurance can be more lucrative for an agent, and which can be easier for new agents. In this post, we’ll discuss the similarities between the two types of insurance as well as the above differences.

How are Final Expense and Medicare Supplements the Same?

While there are four main differences between selling these two types of insurance, there are twice as many similarities, which are:

- They’re both insurance (duh)

- They both cater to the elder American demographic that ranges from ages 50 to 80

- Neither requires a degree or even a high school diploma to sell

- Both have a fast sales cycle — the application process is only a few pages and sometimes just a quick phone call

- The different plan options within each type can be confusing, as we will see below

- Both can be sold face-to-face or over the phone

- The traditional leads for these types of insurance are telemarketed and direct mail leads

- Both can be very lucrative to agents who have a solid sales process and a consistent lead source

Even though there are more similarities between the two, there are four foundational differences, besides the obvious fact that one is life insurance and the other is medical insurance.

1. It’s All About the Benjamins!

Let’s be frank: The majority of the debate revolves around which type of insurance commission pays more — both immediately after a sale, and later on as clients (hopefully) stay on the books over the years. There’s no Medicare Supplement or Final Expense agent salary option, unless you go captive with an agency that doesn’t pay commissions, so you’ll have to depend entirely on immediate first year and renewal commissions to fund your leads as well as your bills and lifestyle.

Agents selling Final Expense often see higher upfront commissions and lower residual commissions. The average commission is 110% of the first year’s premium (or less, if your upline provides other amenities like leads, compensation, training, etc.) Agents selling Medicare Supplements often see a fraction of the commission percentage that a Final Expense agent sees, but the difference is in the amount of the actual premium of the policy; Medicare Supplements can cost more than 2-3 times the average premium of a Final Expense policy, which is $45 a month.

The average commission for a Medicare Supplement is 20% of the first year’s premium. The average monthly premium of a Medigap plan in America is $175, according to the Kaiser Family Foundation, but we like to be conservative, because the agent’s goal should be to save the senior money, so we estimate the monthly premium around $150 a month.

Residual Income is the Main Perk of Selling Insurance

Besides being able to sell online and over the phone, earning residual income is one of the top benefits of selling insurance. As we say in the book, selling Final Expense gives an agent freedom now, and selling Medicare Supplements gives an agent freedom later.

After an agent sells a policy, he gets a commission for the year he sells the policy, and up to 6 years (for Medicare Supplements) to 10 years (for Final Expense) after that policy is sold.

When weighing both the immediate commissions and the residuals, insurance agents are often torn with their options.

Immediate Commissions

Final Expense agents earn an average of $600 per plan they sell. The average monthly premium is $45 a month, which is $540 annually. The average first year’s commission is 110% of that, which means the agent earns $594, basically $600.

On the other hand, Medicare Supplement agents earn an average of $360 per plan they sell. The average monthly premium is $150 a month, which is $1,800 annually. The average first year’s commission is 20% of that, which means the agent actually earns $360.

So who comes out on top for the first year’s commissions?

FINAL EXPENSE AGENTS

The lucrative income that comes with a Final Expense career is the major selling point. For 99 more reasons why you should sell Final Expense, check out Chris Hill’s article, 100 Reasons Final Expense Insurance Is an Opportunity You Can’t Afford To Overlook.

Residual Commissions

For the second year after selling a policy, Final Expense agents can earn 10% in residual commissions. So that $540 in annual premium (AP) that the agent sold the previous year pays about $54.

The second year for a Medicare Supplement agent can be great, because their second-year commission is the same, or 20% in residual commissions. That means the agent earns another $360 for the year.

So who comes out on top for commissions after the first year?

- Individual insurance company practices

- Individual FMO/IMO practices

- Any fees generated by the advances (which average around 1%)

What About Advances?

Insurance agents don’t have to wait for a small commission check each month for each client. Agents often get what “advances” on their commissions. This means the agent gets a greater portion of the annual commission upfront, traditionally 75%. The other 25% is paid “as-earned” in months 9-12. As mentioned above, an agent can incur fees based on the total commissions advanced to him, which will bring down the actual residual commissions paid to the agent.

Over the long term, Medicare Supplement agents will earn more than Final Expense agents because typically a good Medicare agent will re-shop their client’s supplement every 2-5 years (if the client’s health is in good condition) in order to keep rates low. Not only does the agent restart the commission schedule (typically 6 years), but the agent earns a higher income since clients have aged since the agent initially enrolled them.

This means a Medicare Supplement agent can earn the same commission every year he keeps his client. If the Med Supp agent is roughly adding the same number of clients to his book of business every year, it won’t be long before he’s earning five-figure monthly renewals.

Also, there’s a buffer for Medigap agents that Final Expense agents don’t have when it comes to renewals. Call it a “disability clause,” but if a Final Expense agent stops working, the residuals aren’t large enough to make up for the sudden loss of income. If a Medicare Supplement agent stops working, then he has about 2-6 years before his commissions dwindle away.

The clear winner for COMMISSIONS is MEDICARE SUPPLEMENTS.

2. Type of Sales Environment

The second factor in deciding whether you should sell Final Expense or Medicare Supplements is the type of sales environment you’ll be selling in and who you’ll be selling to.

If you plan on selling over the phone, the environment is usually your home or agency office. If you sell face-to-face, then this is where things can be different.

Within the industry, these are the stereotypical consumer avatars or buyer personas:

FINAL EXPENSE

- Traditionally lower income individuals who didn’t save for their final expenses, or didn’t take out a permanent life insurance plan when they were younger and it was cheaper.

- Prospects often live in more urban areas where crime, poverty, and hygiene can potentially be a challenge.

The average filters a Final Expense agent would use to find these prospects are:

- Ages 50-80

- Income $15k-$45k

MEDICARE SUPPLEMENTS

- Traditionally middle to higher-income individuals who spend, on average, more than $2,000 a year in premium for a plan that will help them pay little to nothing out-of-pocket for their Medicare coverage.

- Live in more rural areas where hospital networks are sparsely located and the independence of insurance networks is more advantageous.

The average filters a Medicare Supplement agent would use are:

- Ages 65-80

- Income $20k+

But the funny thing about stereotypesis that they can be wrong. Can you find people with supplements in lower income neighborhoods, and people in rural areas or higher income brackets taking out Final Expense policies? YES!!!

The filters and assumptions above aren’t carved in stone. Many Medicare Supplement agents will prospect for Medicare plans in all areas (especially if they sell Medicare Advantage plans and/or seniors turning 65), while Final Expense agents can target more rural areas hoping they will find seniors who will keep their policies longer than someone from a lower income area.

But even if all of the stereotypes are wrong, there are still two facts that remain between selling the two types of insurance: For one, you are asking for everyday Medicare information, and for the other, you’re asking people what happens to their family when they die. That’s definitely not everyday conversation, asking someone if they prefer cremation or a traditional burial, and who their beneficiary is (and whether they are financially prepared to cover the prospect’s final expenses).

So who comes out on top when it comes to the environment the agent will find himself in? MEDICARE SUPPLEMENT AGENTS

It’s a dirty secret in this business that agents selling Final Expense will have to present in sometimes unhygienic homes that can be messy, filled with roaches, sometimes in the ghetto, trailer park, or project building. Agents selling Medicare Supplements traditionally don’t go to those types of areas for face-to-face sales because the Medicare Advantage Penetration Rate (MAPR) is higher, which decreases the chances of finding a Medicare Supplement prospect. To see a particular area’s MAPR, visit our Insurance Leads page.

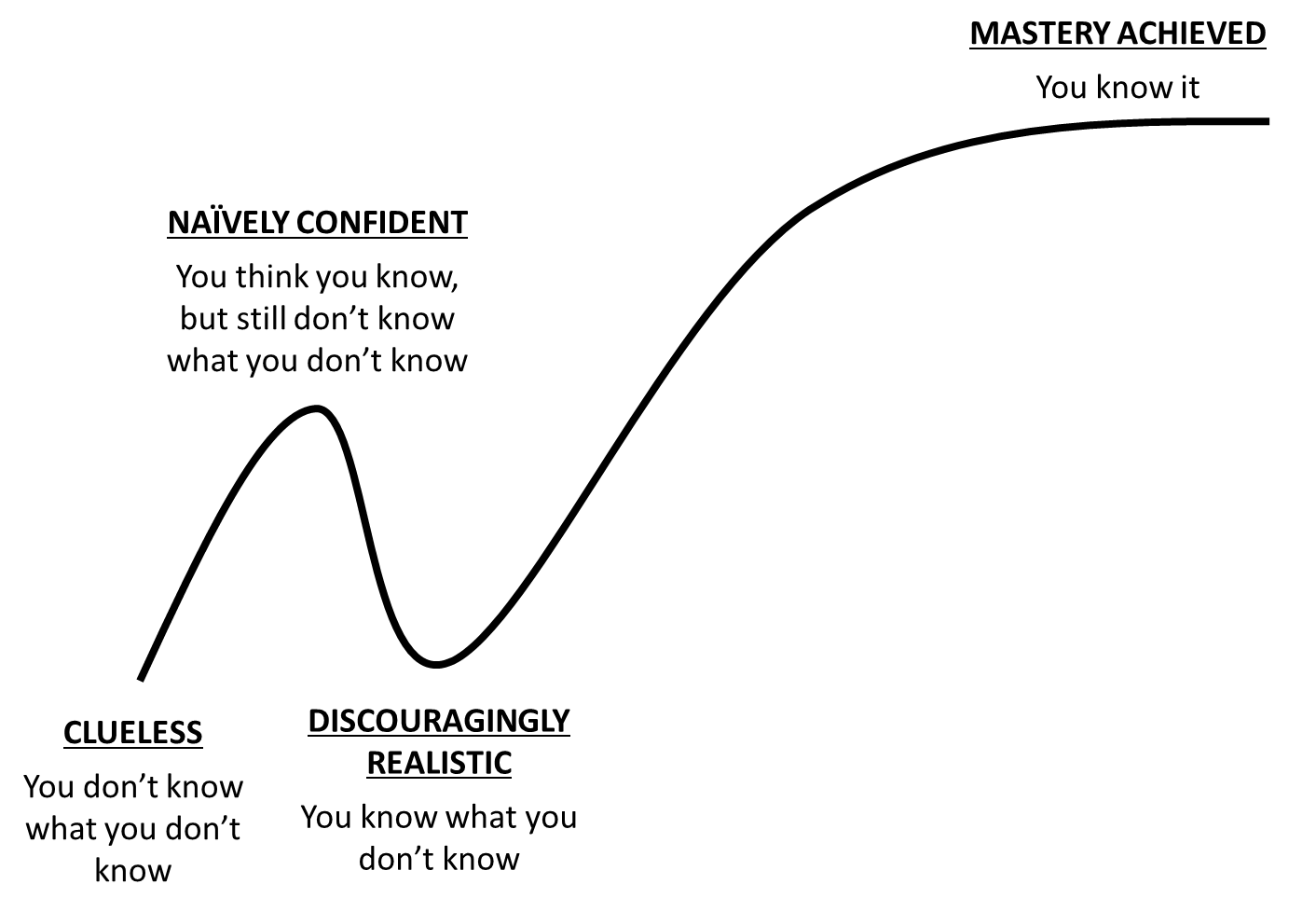

3. Learning Curve

Besides the amount of commissions, the learning curve (or required information to understand how to sell Final Expense life insurance and Medicare Supplements) can vary greatly.

Final Expense is very easy to understand: if you die and you have a plan, your family gets paid, simple as that. This can differ if, instead of a permanent policy, the senior has a term plan that will cancel later on down the road, or if the senior has a Final Expense plan that doesn’t have first-day coverage. Plans with first-day coverage pay out 100% from day one, even if the senior has only paid one premium. Plans that don’t have first-day coverage, and pay out lower benefits in the first and second year, are called “graded” or “modified” Final Expense plans.

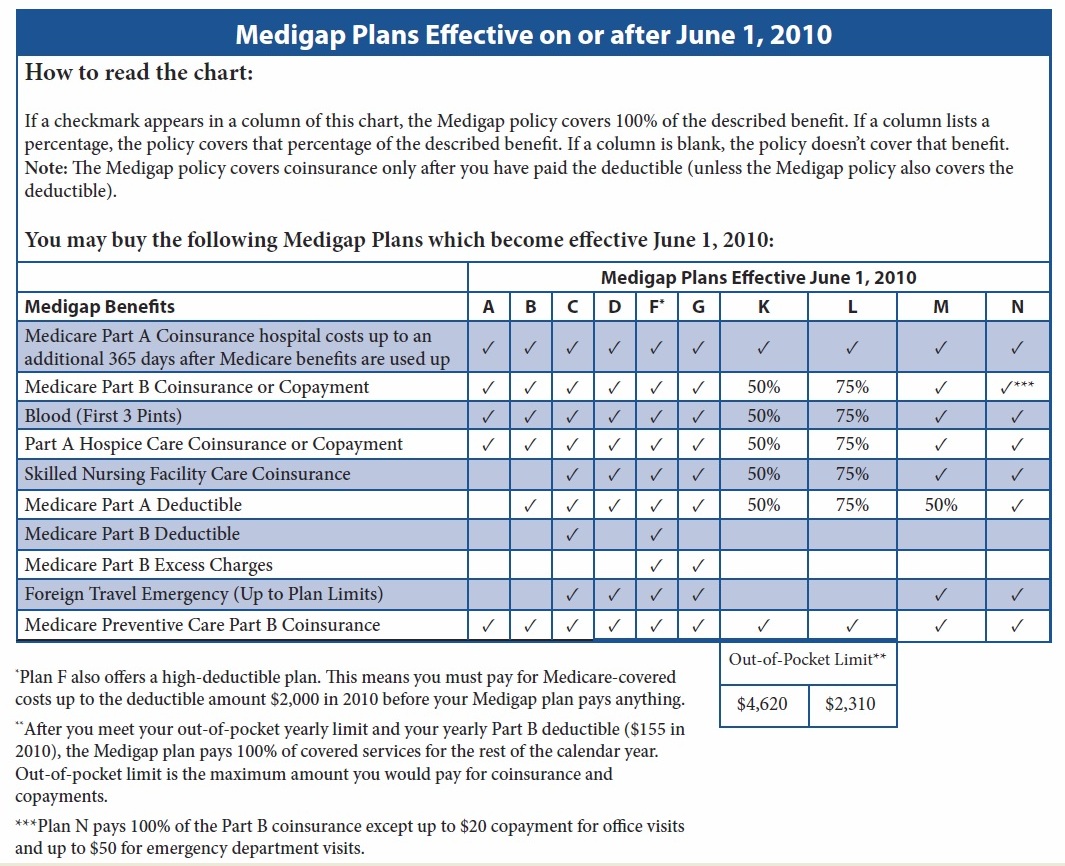

Medicare Supplements aren’t as easy to understand off the cuff. The Medicare system is pretty confusing, because the government, in its infinite wisdom, named the different parts of Medicare after letters of the alphabet, and also named the 11 types of Medicare Supplement plans after the letters of the alphabet, as well.

If this doesn’t confuse seniors enough, many mistakenly think that whether they have a Medicare Advantage plan or a Medicare Supplement, it’s all considered a “supplement.”

This can lead to agents wasting their time in the beginning of the prospecting phase, trying to qualify the lead, because seniors on Medicare Advantage plans can only enroll in a Medigap plan between October 15 and December 7 (provided the lead wasn’t telemarketed to begin with).

What About Medicare Advantage and Offering Part D Plans?

Not only does the agent have to deal with special enrollment periods and lead marketing restrictions when offering Medicare Advantage plans, but with Part D plans, as well. Then there’s the signed scope of appointment form that an agent has to get before the appointment can even happen, which can lengthen the sales cycle considerably, compared to just selling Medicare Supplement plans.

Still, an agent may want to offer these plan options if:

- They live in an area where Medicare Advantage plans are more prevalent

- They want to distinguish themselves from agents who only sell Medicare Supplements

- The marketing restrictions aren’t too cumbersome for them

- They don’t want to leave money on the table

- Want to increase persistency and customer loyalty

To get a better idea of some of the intricacies of specializing in Medicare, check out Allison Bell’s article, 10 Medicare Facts for Agents Who Know Everything and Ginger Szala’s article 11 Medicare Mistakes to Avoid.

So who comes out on top when it comes to the learning curve? FINAL EXPENSE AGENTS

Let’s face it: Learning about the two types of life insurance (term and permanent) and the two types of coverage (first-day and graded or modified), is easy compared to the confusing, and sometimes bureaucratic, Medicare system. Final Expense agents don’t have to worry about doctors dropping out of networks, co-pay amounts changing, or ever-changing marketing guidelines from CMS that apply to Medicare Advantage and Part D plans.

4. Customer Service

Due to the complexities of offering Medicare Supplements (not even taking into consideration the Medicare Advantage plans or Part D prescription plans that often change annually) and having to understand the whole Medicare system in order to answer your clients’ questions, there can be a considerable amount of customer service required to keep Medicare clients, and keep them happy.

Final Expense agents don’t have to learn as much, because life insurance is pretty basic and unchanging. Just because life insurance stays the same doesn’t mean that Final Expense agents don’t have to provide customer service. It just means that most of the customer service is typically concentrated in the first year of the policy.

When selling to seniors in lower income brackets, keeping clients “on the books” can be a challenge. This sometimes requires agents to call clients asking why they missed their monthly payment, or even completely rewriting clients (sometimes with a different company) to lower the payments.

After the first year, the Final Expense agent is all clear from any chargebacks that would happen when clients lapse their policy within the first year. Chargebacks can either be a revocation of the entire first year’s premium, or the months that have been advanced up until the lapse — meaning if the client lapses the policy 5 months in, and the agent gets a 7-month advance, the agent will only have to pay back the two months of commission that were advanced to him.

But even with the concentrated first year’s customer service for a Final Expense agent, the Medicare Supplement agent will have immensely more continual customer service to perform, because changes to Medicare happen frequently.

So who comes out on top when it comes to customer service? FINAL EXPENSE AGENTS

Depending which type of insurance you sell, customer service may mean keeping in touch with your clients, re-shopping their plans and answering their questions (and possibly dealing with Medicare Advantage and Part D plan certification), or hounding them to pay their monthly premium and having to rewrite them (if they don’t lapse completely). Each agent may prefer to drink a different poison, but overall when it comes to the amount of customer service needed, Final Expense agents don’t need to continually keep in contact with clients after the first year, unless of course, you are smart and realize that:

- Because there’s high lapse rates in Final Expense plans, agents have a chance to rewrite their clients later down the road

- Staying in touch can mean staying top-of-mind with clients who may refer friends and family your way whenever there’s a need

- You can cross-sell Medicare plans AFTER you sell a Final Expense policy (chances are it will be a Medicare Advantage plan)

So all in all, which type of insurance is best to sell? We can’t say definitively. That would be like saying Coke is definitely better than Pepsi, when in reality, there are too many variables and personal preferences involved to for us to make that decision for you. Variables to consider when figuring out which type of insurance is the best one for you to sell:

- Are you selling face-to-face or over the phone?

- Does your marketing area have a high MAPR?

- Do you enjoy talking to people about their final wishes?

- Do you prefer larger upfront commissions or the gradual build-up of residual commissions?

- What kind of client do you want to work with: a lower or higher income type of client?

- How much insurance knowledge do you want to learn in order to sell effectively?

- How much customer service do you want to engage in throughout the lifetime of the client?

These are just some of the questions to ask yourself when deciding: Do you prefer Pepsi, or are you a Coca-Cola guy?

If you want to take a closer look at the individual differences between offering each type of insurance, with more comprehensive tables on commissions and the pros and cons of offering each, read the first chapter of our book available on Amazon. There’s also some great info there about the rest of the sales cycle to help you decide which type of insurance you want to pursue, at least initially.

Which type of insurance do you prefer to sell, and why? Let us know in the comment section below!

Thanks as a newbie about to jump in this is great.

Great article, Glen! I have done both, but left Medicare entirely due to the onerous CMS regulations. (I live in one of those MA saturated areas.) I picked FE originally after reading The E-myth. I had started out in home service, so there was similarity between both the product and the clientele. But the big thing I saw was a system that was easily transferable to new agents. However, these days I’m back in personal production, loving the simplicity of FE myself! An extra note: I also do a fair amount of home service policies. That system has elements of both, in that the first year commissions are lower than FE, but the renewals are MUCH higher (and last for the life of the policy). More service required, but still simple and straightforward. So – Coke or Pepsi? I guess I’m a Dr. Pepper guy! 😉

Personally I am a fan of both, depends on the mood, are we talking about soda still? I prefer to do Medicare, my clients just stick longer, but selling the occasional $75 a month premium is pretty nice. I guess both?

I started out selling life insurance exclusively (Mortgage Protection/Final Expense). I am a big believer in cross-selling your book of business once you have built up a large enough audience to market other offerings.

I think that is the beautiful part of selling Medicare Supplements! You can create a large audience of clients who are great to target for Life policies, Financial Products, or other policies such as Cancer or Home Health Care.

First, it is important to master the niche of your choice. Whether that niche is Pepsi or Coke 🙂

I did not know that the final expense career was such a positive one. Because agents receive a commission on sales that they make it incentivizes them to make as much money as possible. I like that the agents make as much money as they decide to, so the people that work harder will make much more than those that don’t work very hard.