A book, a blog, and other marketing resources for insurance agents:

Earlier this year, I realized that I was getting a lot of calls from insurance agents asking similar questions about how to contact, qualify, and ultimately sell to the senior leads that Lead Heroes provides. They couldn’t find practical answers in any insurance journal, book, or online forum (without copious amounts of digging and piecing together of various posts). So I started brainstorming with Justin Bilyj, an independent insurance broker and digital marketing manager, about ways to help agents learn the fundamental insurance sales skills and strategies they needed to approach prospects.

We knew that most insurance companies and agencies don’t provide client-centric sales insights in their product-based training, and we knew that many new agents can’t afford or access the industry’s expensive, exclusive, advanced training for producing agents. As a result, we saw new agents struggling to piece together nuggets of advice from blogs, forums, and company brochures, questioning how to assemble an effective sales process.

We came up with a great idea to answer their questions by creating a comprehensive insurance sales training book, offering practical tips to help agents sell Medicare Supplements and Final Expense plans to seniors. As soon as the two of us started comparing our sales processes, we noticed just as many differences as there were similarities. Very quickly, we agreed that there’s not just one right way to approach a lead, present an insurance plan, or close a sale. We wanted to cover a wide range of sales styles in our book, so we placed a call for help.

Which is why earlier this summer, we started looking for experienced insurance agents who were willing to share tips, scripts, and insights from their sales process.

Which is why earlier this summer, we started looking for experienced insurance agents who were willing to share tips, scripts, and insights from their sales process.

We asked them to collaborate with us on this training resource, presenting it as an opportunity to:

- 1. Establish their expertise

- 2. Build a strong personal brand,

- 3. Raise the bar in the industry by sharing best practices.

Dozens of agents responded, and we culled through their responses to find the best advice and most helpful answers to common questions about selling insurance.

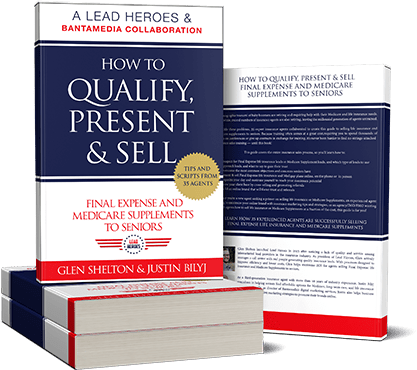

After compiling their input into our own sales experience, we’re excited to announce that Lead Heroes’ debut sales training book, “How to Qualify, Present & Sell Final Expense and Medicare Supplements to Seniors,” is now available on Amazon! The book features tips and scripts from more than 35 agents, showcasing practical advice that will help new agents establish an effective sales process, while helping experienced agents hone their approach to be more efficient whether selling in-person, on the phone, or online.

Insurance Marketing Simplified

The launch of our new book seemed like the perfect opportunity to redesign the Lead Heroes website and unveil our new mission: to simplify insurance marketing for agents. Although generating telemarketed leads is still our specialty, we’ve always wanted to be much more than just a lead provider. Now, we can officially say that we’re expanding our role as a resource to help insurance agents succeed by transforming leads into long-term clients.

Of course, we’ll still continue offering the high-quality, low-cost Medicare Supplement leads and Final Expense life insurance leads you’ve come to expect from Lead Heroes. But if you’re wondering how to turn those leads into clients who trust and refer your service, we want to help you with that, too. The book will walk you through the entire sales process—from ordering leads to qualifying prospects for coverage, presenting plans, and after closing a sale, delivering consistent customer service, earning referrals, and building an online brand to sustain your business.

Beyond the book, we’ll also be sharing helpful articles, reviews, and resources on our blog regularly to continue answering insurance agents’ questions about contacting leads, closing sales, and keeping business running smoothly. We’re kicking off our Medicare and life insurance blog with four blog series focused on helping agents improve:

- 1. The Insurance Agent Sales Training Blog Series shares tips and strategies to sharpen your sales process and close more sales.

- 2. The Online Branding Blog Series teaches agents how to polish their online brand to increase referrals, establish expertise, and attract internet leads.

- 3. The Insurance Agents’ Review Corner explores tools, services, and software solutions agents can use to streamline their businesses.

- 4. The Insurance Agents’ Advanced Guide to Leads explains the different type of insurance leads available, how to generate them, and how to effectively sell to each type.

Lead Heroes is not your average lead provider, and this won’t be your average life insurance blog or Medicare website. We like to think of ourselves as problem-solving superheroes who save insurance agents from mistakes and misunderstandings to help them sell successfully.

That means we’ll answer any question, review any tool, and explain every plan the best way we can to give agents the fuel to succeed in the field.

We aim to be approachable enough to help new agents learn the ropes, but also resourceful enough to help experienced agents grow and improve. Whether you’re just getting started or consistently selling policies, we want our blog to become a top resource for insurance agents, akin to some of the top insurance news sites and life insurance blogs, like Insurance Journal, Insurance News Net, or Life Happens. But to do that, we’ll need your help. Keep reading.

Elevating the Insurance Industry

Here at Lead Heroes, we like to look at the big picture. For example, we don’t think of insurance leads as a commodity. We think of each lead as a senior with unique needs and concerns, who has interacted with one of our callers about a Medicare Supplement or Final Expense plan and needed assistance planning for the future. We care just as much about helping these seniors as you do, and that’s why we specialize in connecting them with insurance agents who can diagnose and solve their needs with the right plan.

Unfortunately, there’s a huge gap in the senior insurance industry right now, as record numbers of baby boomers are retiring—at the rate of 10,000 a day, according to the Washington Post. These seniors need help with their Medicare and life insurance needs, but 1/4 of the insurance workforce will be retiring right alongside them within the next couple of years.

Millennials aren’t entering the insurance industry as fast as boomers are leaving. They find it boring, and most of those who give it a try—90% to be exact—burn out before lasting a full year in this business.

If new, young agents can’t afford or access the training, they need to succeed in the insurance industry, then who will help this tsunami of seniors choose the right Medicare Supplements and Final Expense plans?

That’s why our goal is not just to provide senior leads to agents. Our goal is to help agents assist seniors. By helping agents sell the right plans, we can help the entire industry meet the needs of retiring seniors. By helping insurance agents sell more effectively, we’re really helping Medicare beneficiaries and Final Expense plan beneficiaries save money. So we’re not just helping agents make money; we’re helping seniors save money, boosting their local economy (rather than padding the insurance company’s pockets).

At a tumultuous time when medical expenses and funeral costs continue to rise, it’s more important than ever for insurance agents to develop client-centric sales processes that keep the seniors’ best interests at heart. In our client-centric focus to help agents succeed, we’re keeping seniors’ needs close at heart, too.

We are gonna need a bigger collaboration!

To achieve our new big-picture focus to help the insurance industry as a whole, we’re going to need some help. We’re still looking for more collaborators who are willing to share their sales advice with other agents by:

- Guest Posting on our blog about an insurance sales tip, tool, script or strategy that has been effective for you. Guest posts should offer practical, actionable advice to help other insurance agents who sell Final Expense life insurance and/or Medicare Supplements, in 750-1200 words or more. We’ll include a link back to your website and LinkedIn profile.

- Adding your voice to articles and other resources on our site by participating in upcoming surveys, commenting on our blog posts, engaging with us on social media, and sending us ideas you’d like to read about or have some collaborators answer. As you saw in the book, we love to incorporate a range of perspectives from different agents, so as we keep developing new content for our Medicare and life insurance blog, we’ll be putting out calls for collaborators to contribute questions, answers, and insights.

We believe the industry does better when we work together. If you think so too, you’re just the type of contributor we’re looking for. SIGN UP to become a collaborator, and you can:

1. Give back to the industry.

You probably had a mentor somewhere along your journey into the insurance industry, or at least a more seasoned agent who gave you some valuable advice along the way. Because of the demographic crisis I explained earlier, young agents today are in great need of advice and guidance from their predecessors. But at the rate these pros are retiring, many up-and-coming millennials are missing out on the knowledge transfer.

Collaborating with us could be your chance to pass down your wisdom and help train the agents of today and tomorrow. Every agent’s style is different, and every senior’s situation calls for a unique approach. There’s got to be something you’ve said, read, or heard that has helped improve your sales process, that another agent could learn from. There are certainly mistakes you’ve made along the way that could help other agents improve, too. By sharing these successes and missteps to begin building best practices, agents can help each other grow and improve the industry as a whole.

2. Establish your authority.

Of course, it’s good to be considered an expert in your field by contributing your sage advice to articles on other sites. But now, it’s more important than ever, since Google laid out new guidelines revealing how it ranks the quality of content on a website—particularly any website that “could potentially impact the future happiness, health or financial stability of users.”

These types of sites, which provide medical information or financial advice (like information about life insurance or Medicare Supplements) are classified as “Your Money Your Life” sites. Google holds YMYL sites to higher content quality standards than the average blog, because the accuracy of this information could seriously impact readers’ lifestyles.

Google looks for high-quality webpages that display Expertise, Authority, and Trustworthiness, abbreviated as E-A-T. When it comes to YMYL sites featuring life insurance blogs or insurance news articles, Google specifies that the content should be written by qualified experts. So by contributing your expertise on our blog, collaborators can build trustworthy content that Google will “E-A-T” up, helping to build your online presence and search engine buzz.

3. Build search engine buzz for your brand and website.

The added bonus of contributing your expertise and advice to our Medicare and life insurance blog is that you’ll get a backlink to your website, which will help to boost your search engine ranking. If you don’t have a website (get one) then you can use your LinkedIn profile.

Backlinks help one’s website get discovered in the search engine rankings, kind of like a vote of confidence from one website to another saying, “this guy has trustworthy valuable content to share.”

4. Be the first to know about contests, discounts, and giveaways.

We don’t like to ask for something—especially your best-kept sales secrets and insurance insights—without offering anything in return. That’s why our collaborators are the first (and sometimes the only) ones to know about contests, discounts, and giveaways, giving them opportunities to earn free leads in exchange for contributing to our content. You definitely don’t want to miss out on the discounts and freebies we will be sharing!

Many agents are better than one

Just think: The better informed that agents are about how to effectively present different plans to different types of leads, the better informed that seniors will be about their options, and the more wisely they’ll spend their money. Helping both seniors and agents will be hugely rewarding for everyone, so be sure to SIGN UP as a collaborator (if you have any questions feel free to reach out to us).

Medicare Supplements and Final Expense plans are hugely important decisions on a fixed income, when seniors are trying to leave a legacy for their loved ones instead of leaving an economic burden of debt.

What legacy do you want to leave in the industry?

Thanks for the great manual